International transfers with Holvi

Send and receive international transfers with Holvi. Grow your business and go international – all for a transparent and fixed price.

- SEPA and SWIFT

- From your business account

- Fast processing

- Transparent fixed price

SWIFT transfer

International money transfer

Need to send or receive money outside the SEPA region? No problem! With Holvi you can now send and receive international payments SWIFT*ly.

Currently, you can only make transfers in euros to select countries. Other currencies and countries coming soon!

- Fast: SWIFt transfers within 2-4 banking days

- Safe: Bank-level security

- Transparent: Only €6 per SWIFT transfer

SEPA transfers

Free SEPA transfers

Did you know? Transfers in euros within the SEPA region are free and work the same as domestic transfers. Just create a new bank transfer and enter the recipient’s IBAN. Done!

The SEPA region includes the 27 EU countries plus Andorra, Monaco, San Marino, Switzerland, Great Britain, Vatican City, Saint-Pierre and Miquelon, Guernsey, and the Isle of Man. Discover SEPA transfers

International transfers at a glance

All-in-one solution

Make SEPA or SWIFT transfers directly from your business account – no detours via third parties!

International business

Let’s go abroad! Grow your business past your domestic borders.

At a fixed price

Only €6 for every inbound or outbound SWIFT transfer – regardless of transfer amount.

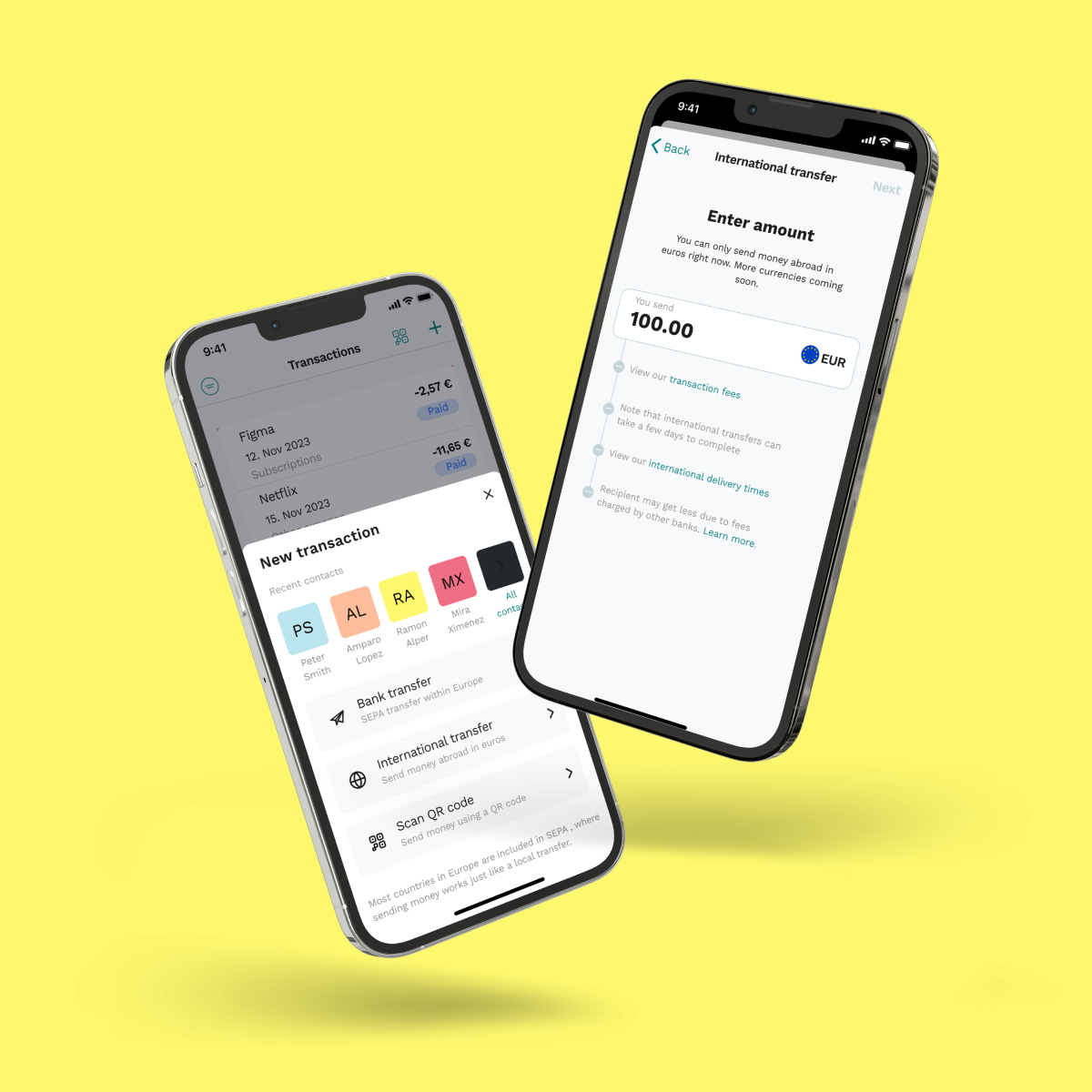

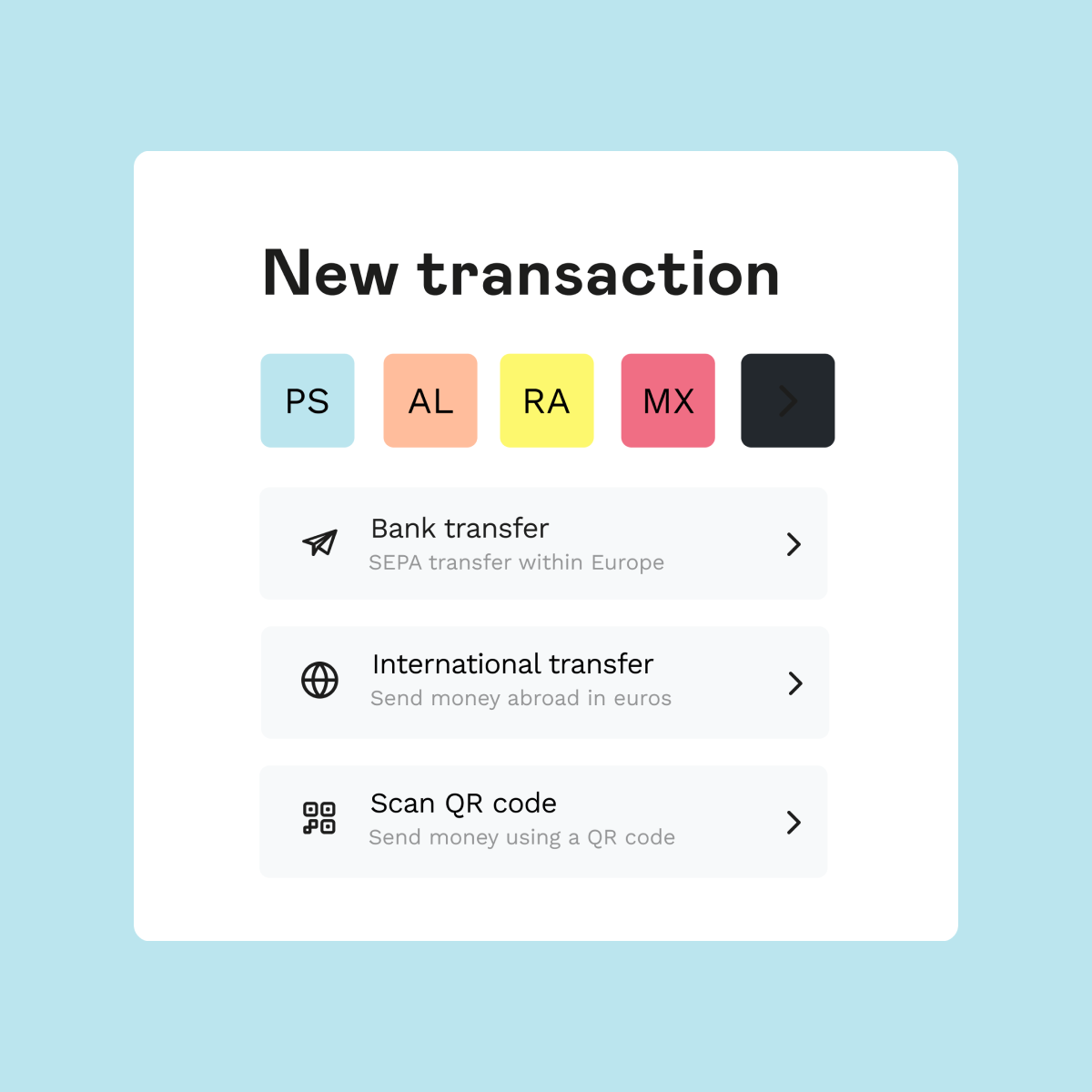

Start SWIFT, in just 3 steps

International transfers are easy with Holvi – try it yourself!

1. Log into your Holvi account

2. Choose International transfer, enter recipient, choose currency* and amount

3. Confirm transfer – done.

*Currently international transfers are only available in euros. More currency options coming soon.

FAQ’s – International transfers

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global banking network that is used to process payments in foreign currencies. SWIFT transfers or international transfers are used when you want to make cross-border payments or if SEPA transfers in euros are not possible.

The BIC (Business Identifier Code, sometimes called SWIFT code) is an internationally recognised sort code. It consists of 8 or 11 alphanumeric characters. The BIC is required for international transfers.

The SEPA (Single Euro Payments Area) is a European network that lets you send and receive money in euros to anywhere in the European Union (EU), as well as several non-EU countries. You can find the list of all countries included in the SEPA network here.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global banking network that is used to process payments in foreign currencies. SWIFT transfers are subject to a fee and take longer to process than SEPA transfers. In contrast to SEPA, which is limited to the European area and euros, SWIFT can be used to make payments between a larger number of countries and currencies worldwide. The range of currencies and countries depends on the bank or payment institution you are using.

International transfers sent via SWIFT generally arrive within 2-4 business days. However, delivery times vary based on factors like destination country, time zones and different banking procedures.

Before your funds are credited to the recipient, they undergo anti-fraud and anti-money laundering checks, which take time.

The SWIFT network is designed so that the banks and intermediary banks involved in the transfer can deduct fees from the transfer amount. Therefore, the full amount does not always reach the recipient’s bank account. By selecting a SWIFT fee model, the payer can determine which side should bear the fees.

- SHA: The transfer fees are expected to be shared between the payee and the recipient.

- OUR: The transfer fees are expected to be paid entirely by the payee before the transfer.

- BEN: The transfer fees are expected to be covered by the recipient of the transfer.

Outbound SWIFT transfers: Holvi only supports the SHA model (fee-sharing model) for outgoing SWIFT transfers. You pay the flat fee for SWIFT transfers to Holvi. The receiving bank may deduct fees from the transfer amount – which means the recipient may not receive the full transfer amount.

Inbound SWIFT transfers: The payer chooses the fee model – you and Holvi have no influence on this. Therefore, you may not receive the full transfer amount.

- Incoming payments with SHA (fee sharing model): You pay Holvi’s flat fee for incoming SWIFT transfers. You may still receive a lower amount if intermediary banks deduct fees.

- Incoming payments with OUR (principal model): You receive the full amount. You only pay Holvi’s flat fee for incoming SWIFT transfers.

- Incoming payments with BEN (recipient model): As the payment recipient, you bear all the costs – you will not receive the full transfer amount and you will have to pay Holvi’s flat fee for incoming SWIFT transfers.

Not yet, but soon. Offering euro transfers outside SEPA is our first step towards offering true foreign exchange transfers at Holvi. We’re working hard to bring you currency conversions and an expanded list of supported receiving countries in 2024.

Right now, there’s a specific group of countries outside the SEPA region where Holvi customers can make transfers. We’ve chosen these countries carefully to make sure everything runs smoothly when you send or receive money. You can find a full list of the supported countries in our service description for international transfers.