The alternative to a business savings account 4% yield for new customers

With Holvi, GmbHs and UGs can park cash flexibly, withdraw it easily when needed – and benefit from ongoing returns. New customers receive a guaranteed yield of 4% p.a.¹ for 4 months from initial deposit, on balances up to €100,000 during the campaign period.

4% p.a. yield for new customers – 4 months from deposit, valid until 31.03.2026.¹

Top-rated by small businesses

Special offer for new customers

4% yield for 4 months

More yield from day one

Open a Holvi business account (GmbH or UG) before 31 March 2026 and qualify for our promotional offer.

Four months. Four percent.

Earn a guaranteed 4% p.a. yield¹ for the first 4 months after your initial deposit.

Reliably protected

The offer applies to balances of up to €100,000 per customer.

Returns for businesses

Your promotional yield will be paid out as a single rebate at the end of the 4-month period.

Benefits at a glance

Optimise liquidity – with no transaction fees

Your money will be back in your account within a few working days. No lock-in periods or restrictions. And: no transaction fees.

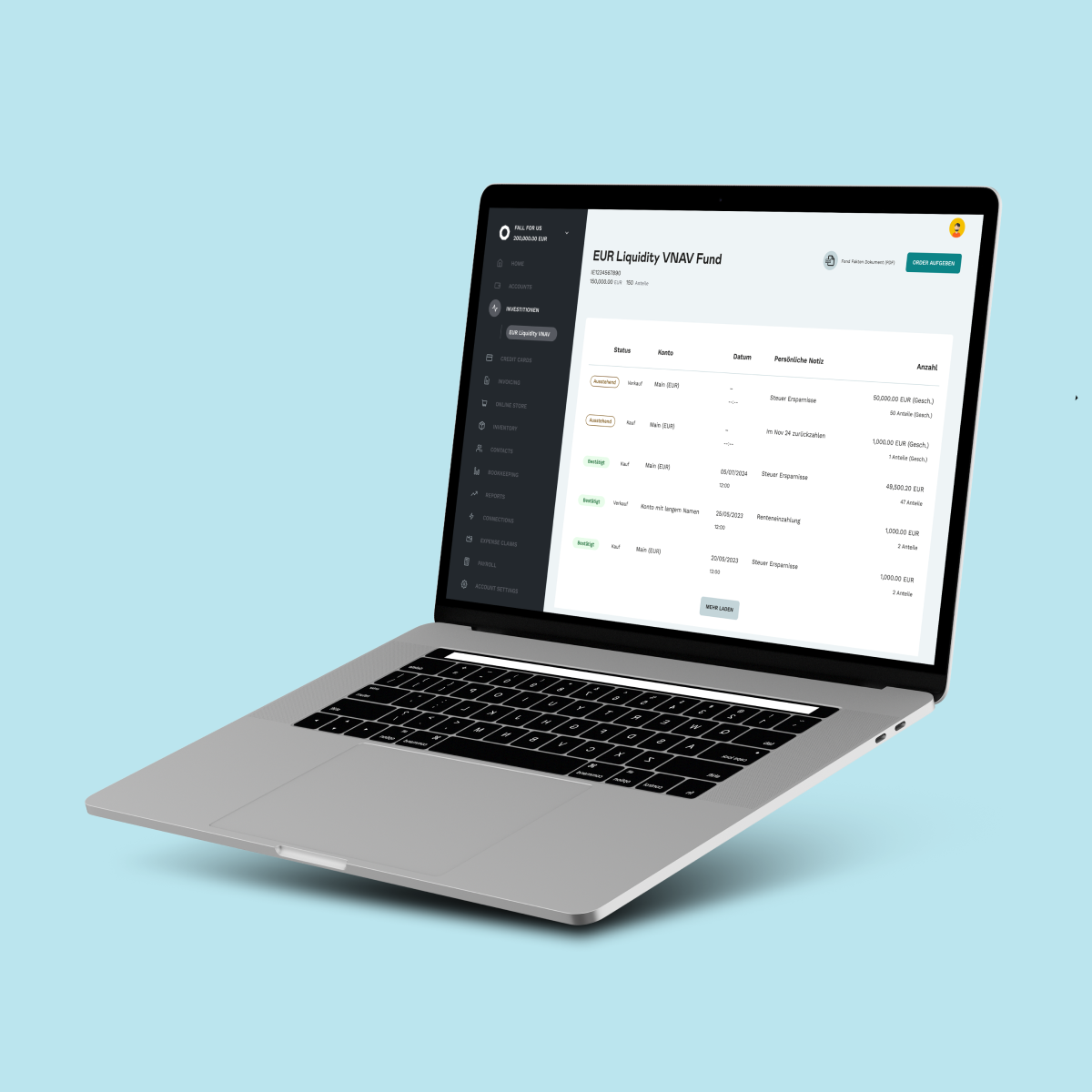

Really simple – even for your accounting

Directly from your Holvi account. No extra depot, no new app. Tax documents automatically available – your accountant will love it.

Save on average 2-4 hours of bookkeeping time per quarter.

What your capital can do

If you park €50,000 for 3 months at a net return of 1.50% p.a., that’s an estimated gross return of about €190². No lock-in. No interest-hopping.

²Example calculation is for illustrative purposes only. It’s based on a constant net return of 1.50% p.a. and an assumed investment period of three months.

Typical use cases – How other Holvi customers use it

Reserves after tax audit

The CEO of an UG parks €80,000 after a tax audit in Holvi investment access. Everything is documented – their accountant doesn’t have to ask questions.

Liquidity after funding

A startup has received fresh funding – and temporarily invests €150,000 in the fund, instead of letting the money sit idle in their account. This way, they generate returns while keeping their capital liquid.

Better use of planned expenses

An agency reserves €30,000 for salaries and rent for the next three months – until then, the capital works for them instead of staying inactive.

Buffer for project-free months

A consultancy firm uses Holvi to bridge their quiet months in the summer. The capital remains liquid but is not sitting unused.

Got questions?

Speak with our team to learn more about our investment access.

Is this offering for you?

- You run a GmbH or UG

- You have spare capital you don’t currently need

- You want to park it in a simple, transparent way – without any risky speculation

Smart returns, boringly good

This product isn’t exciting. And that’s the point.

Holvi investment access is designed so that you don’t have to worry about it.

Park your capital, see the returns, stay flexible – without any risky speculation, no interest-hopping.

Trust, built by professionals

Your money is managed in a money market fund by DWS – one of Europe’s largest asset managers and part of the Deutsche Bank Group. DWS brings over 60 years of experience in institutional asset management to the table – ensuring that your capital works efficiently for you.

How it works – In 3 simple steps

1. Open your Holvi account

For your GmbH or UG – 100% online.

2. Activate investment access

Verify your company details, select the fund in the Investment section, set your amount – and you’re done.

3. Manage your capital flexibly

Your money works in the background. Withdrawals are easy.

Benefits and risks at a glance

Benefits

- Benefit from current money market rates.

- No need to transfer between different savings accounts.

- You have easy access to your capital.

- Money market funds are stable due to short-term investments.

- Regular distributions simplify your planning.

Risks

- Money market funds are generally low risk, but not risk-free. Value losses are possible.

- The return is not guaranteed and can drop.

- Financial instruments in the fund can fail and cause losses.

FAQ

In the money market, banks, large companies, or the government borrow or lend money on a short-term basis. Money market funds (MMFs) invest your money in these interest-bearing securities, such as overnight or term deposits with a maturity of less than a year. The interest paid on these loans generates the fund’s returns.

MMFs are generally a low-risk way to grow your business’s cash. Banks and large companies have used them for years to preserve capital and manage liquidity, as a means to help mitigate inflationary effects.

A single fee structure applies to all users of the Holvi investment offering: 0.50% p.a. service fee on the invested amount. Learn more here.

To open an investment account with Holvi, you need to meet a few requirements. For now, this offer is available for GmbHs and UGs only. You can find all the details in our Help Centre.

It takes just €20 to start earning yield on your spare cash, with no upper limit on how much you can invest.

Once your sell order is executed, the capital will be available within 3 to 4 working days. We’re working on speeding up this process in the future to give you even quicker access to your funds.

Returns are automatically credited to your business account once a month.

¹ For business accounts opened for the first time with Holvi during the promotional period (01.10.2025–31.03.2026) and approved for money market funds, a special return of 4.00% p.a. applies for the first 4 months from the initial deposit. The special return is calculated on daily balances of up to €100,000 per customer in the money market fund. The additional earnings will be paid out as a one-time rebate to the Holvi business account after the 4-month period.

The 4.00% p.a. consists of the variable net yield of the money market fund (currently 1.45% p.a., based on the annualised 30-day performance after deduction of fund manager and service fees (0.5 %), as of 9.1.2026) plus a guaranteed rebate paid by Holvi. This estimate assumes constant performance over a full year; however, money market returns may fluctuate depending on market conditions. Holvi exclusively guarantees the promotional top-up to 4.00% p.a. for the 4-month period. The offer is valid for a limited time and may be terminated early if the budget is exhausted. Full terms and conditions available here.

Investing carries risks to the capital invested. As with any investment, the value of your investments can go up or down. Past performance is not a reliable indicator of future results. The returns stated are for illustrative purposes and may differ from actual product performance. This is not an offer or investment recommendation. Investors should note that investing in money market funds is not a guaranteed investment and carries different risks compared to a traditional savings account. Access to investment options is granted upon successful onboarding.

Investment brokerage under the liability and for the account of lemon.markets brokerage GmbH, Kottbusser Damm 79, D-10967 Berlin.