Apply now!

A credit card that helps run your business? Yes please.

Find financial freedom with Holvi’s business credit card – for the boldly self-employed. Use your credit line to manage expenses worldwide. Buy now, pay later.

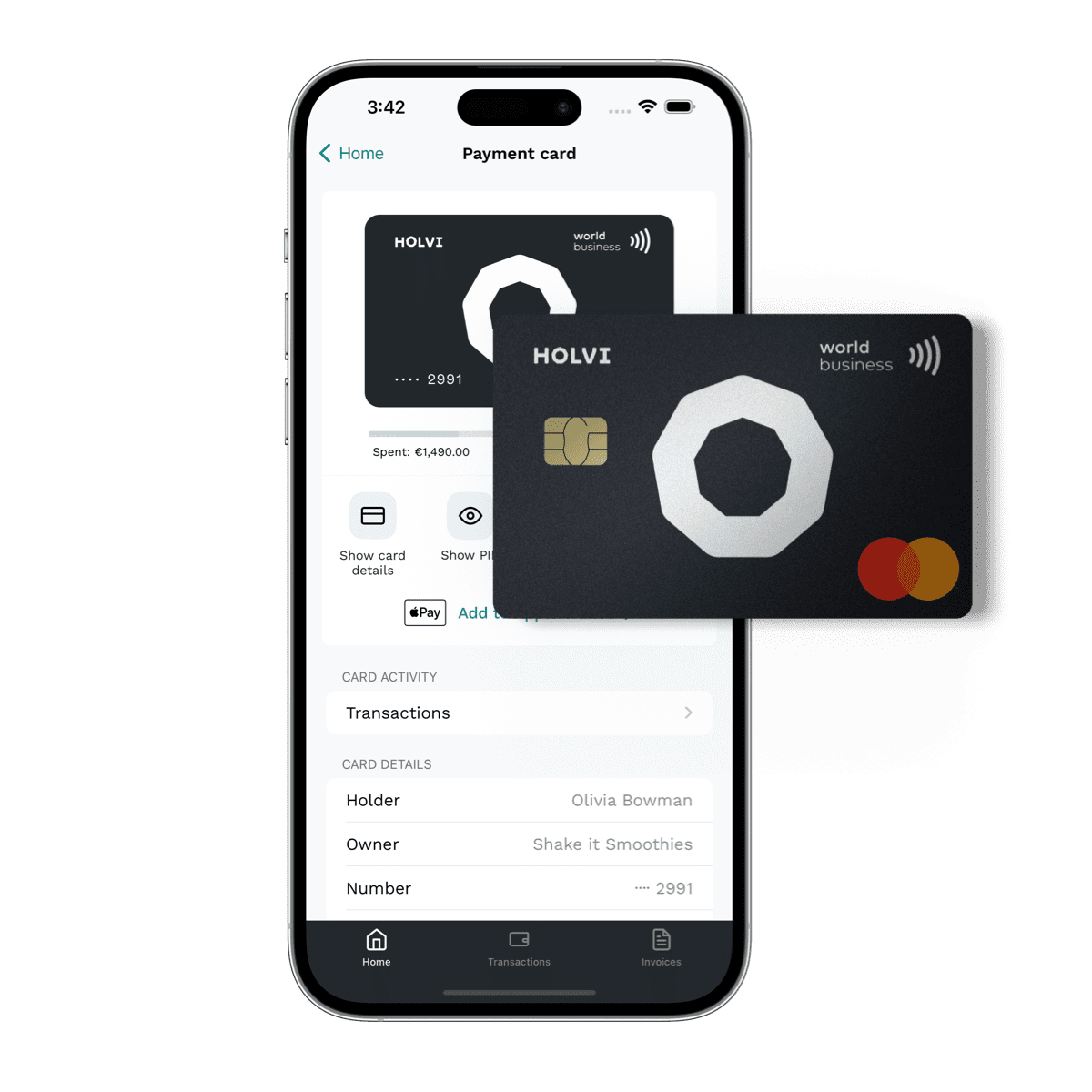

Holvi Business Credit Card

Pay anything, anywhere

The Holvi credit card is here for all your business expenses, big and small – even when balance is low. Introducing your new financial cushion.

- Business credit card – with credit line up to €5,000

- Pay worldwide – wherever Mastercard® is accepted

- Highest level of acceptance – for SaaS subscriptions, car rentals and hotel bookings

- Secure online payments – backed by Mastercard® 3D-Secure and Holvi’s bank-level security

Run your business with Holvi

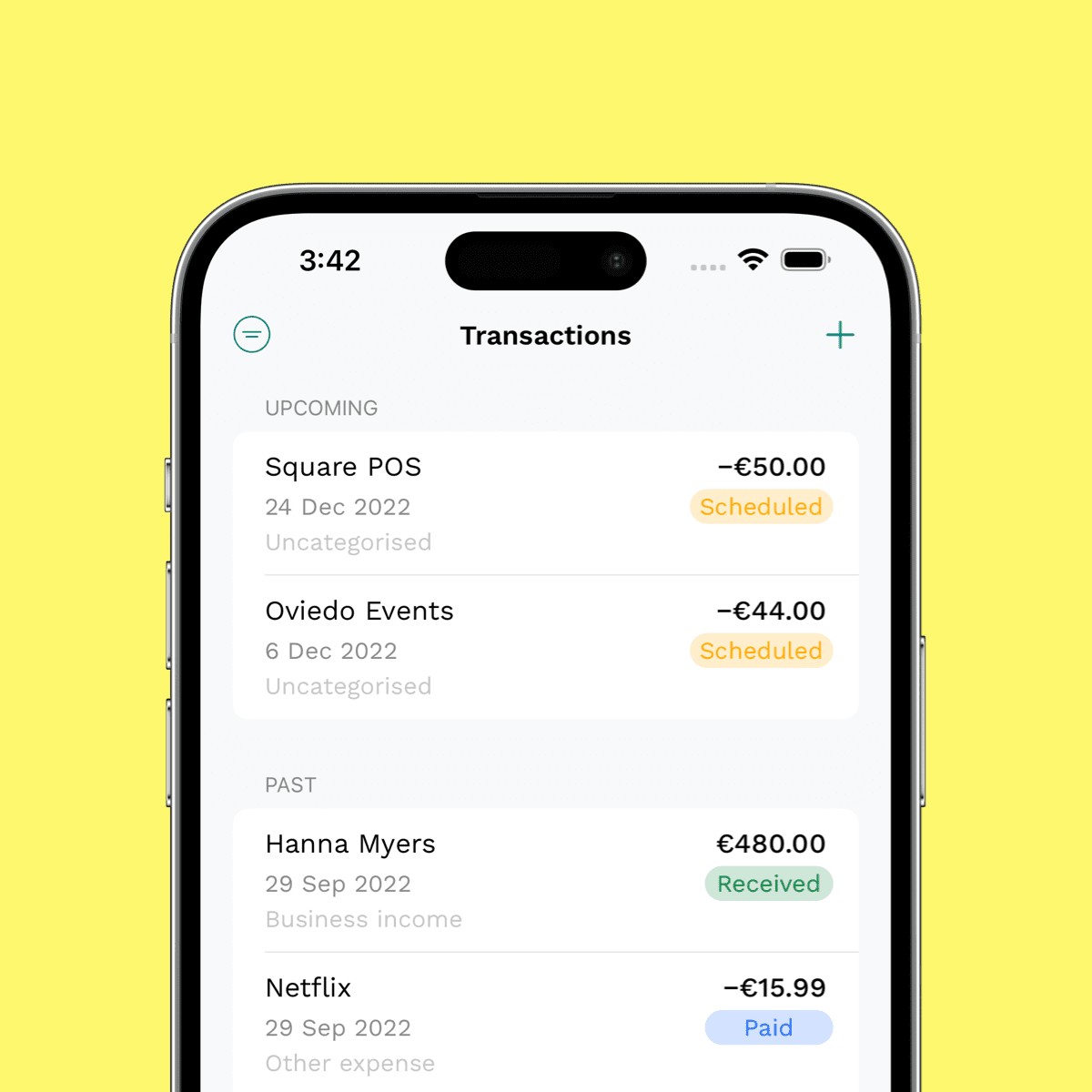

Manage receipts & invoice clients

We created our credit card to work seamlessly with Holvi Pro. Manage all your finances in one account and stay tax ready – with expense management, unlimited invoicing and accounting features.

- Business account with German IBAN

- Push notifications for card payments

- Scan and save receipts

- Manage and categorise expenses

- Create and send invoices & e-invoices

- Prepare accounting for tax time

- Connection to DATEV & lexoffice

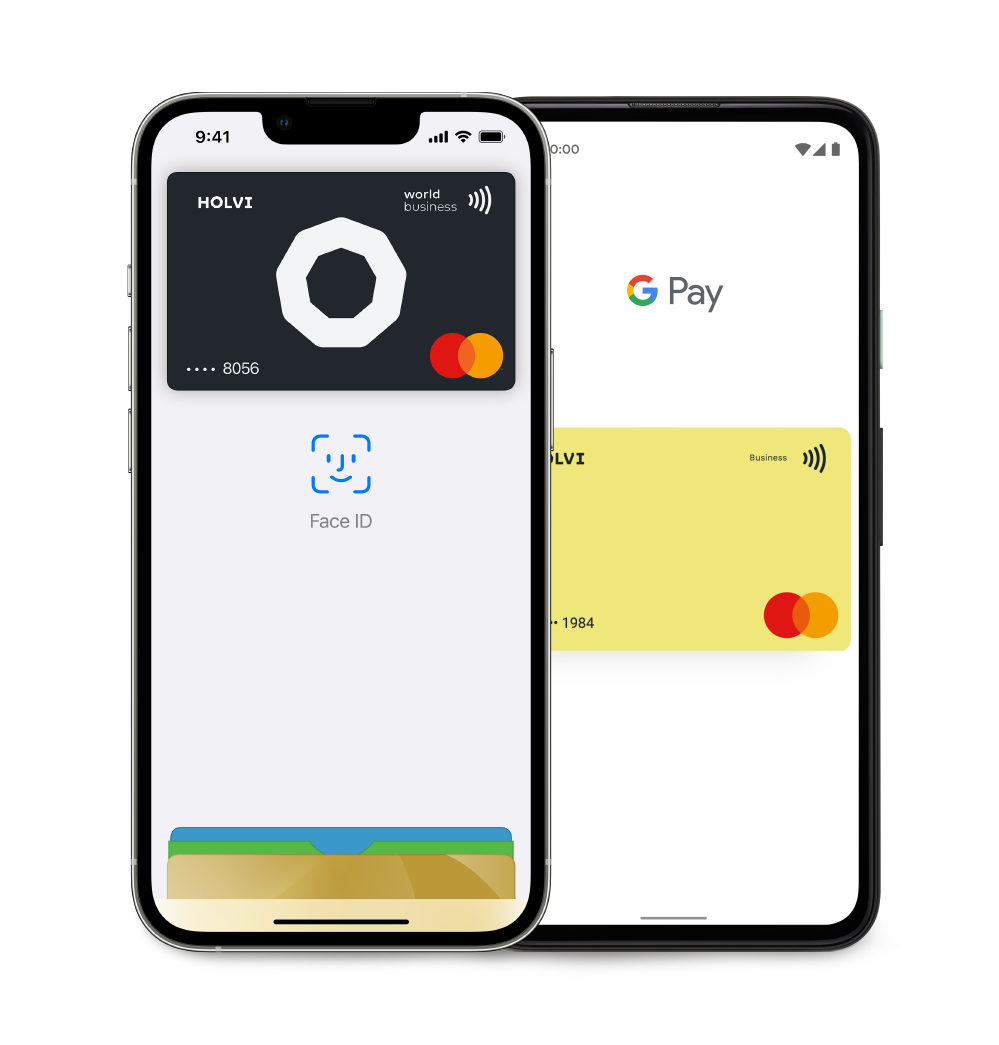

Apple Pay & Google Pay

Fast and easy card-free payments

Now you can enjoy all the benefits of your Holvi card using Apple Pay or Google Pay™️. The fast, easy and secure way to pay in stores, apps and online with just a touch or a glance.

Buy now, pay later

Unlike conventional business payment cards, with the Holvi credit card we don’t debit transactions directly from your account.

Instead, you decide when you pay back your purchases. The Holvi credit card is available in 3 variations:

- Pay back next month – buy time and cover payment gaps

- Pay back in 3 instalments – split larger expenses

- Pay back in 6 instalments – for maximum flexibility

Want to pay back early? You can pay back your balance before your monthly statement – 100% interest-free.

Your financial cushion

A credit card with credit line up to €5,000 to spend as you like – to soften all life’s expenses.

✔️ Invest in your business

Fund projects you can’t afford upfront. Cover urgent expenses – like that new software licence you need for ongoing work.

✔️ Cover payment gaps

Fluctuating income? Clients paying late? Bridge payment gaps and keep business running smoothly.

✔️ Split larger expenses

Big purchases can put a dent in your cash flow. Split them into manageable instalments, and pay them off over time.

✔️ Buy time

With credit card transactions due at the end of next month, you have ample time to budget.

For the self-employed

Up to €5,000 credit line. No individual loan pre-approval – for all life’s solo expenses.

Tailored interest rate

Competitive rates from 8–17% based on your credit score. No interest on interest.

Monthly billing

You’ll get a monthly credit card statement with your repayment amount plus interest.

Repay interest-free

Want to pay back early? Clear your balance by end-of-month, interest-free!

Available in 3 instalment plans

How much flexibility do you want? Choose how you repay your credit balance.

Repay next month

€6 per month card fee*

- Cover payment gaps

- Pay back this month’s expenses at the end of next month

- Or you can pay back in this month – interest-free

- Interest rates from 8% – 17%

- Credit limit of up to €5,000

- Virtual and physical card included

Repay in 3 instalments

€9 per month card fee*

- Split larger expenses

- Pay back this month’s expenses in 3 monthly instalments starting next month

- Or you can pay back in this month – interest-free

- Interest rates from 8% – 17%

- Credit limit of up to €5,000

- Virtual and physical card included

Repay in 6 instalments

€12 per month card fee*

- For maximum flexibility

- Pay back this month’s expenses in 6 monthly instalments starting next month

- Or you can pay back in this month – interest-free

- Interest rates from 8% – 17%

- Credit limit of up to €5,000

- Virtual and physical card included

* Only available on our Holvi Pro pricing plan. Credit card fees are billed separately, in addition to the cost of Holvi Pro.

Top-security credit card

& business banking

Secure login and online card payments with 2FA and Mastercard® Identity Check™.

As a licenced payment institution, we follow the same strict security rules as a bank.

Lock and unlock cards in-app, get notified the moment a payment goes through.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi is all you need – from business account, to online invoicing, to online bookkeeping.