Easy e-invoicing for the self-employed

E-invoicing is becoming mandatory in Germany. But it’s also just a better way to get paid. Create and send XRechnung & ZUGFeRD invoices effortlessly in Holvi.

- XRechnung and ZUGFeRD formats

- E-invoice the Federal Government

- EU-standard e-invoicing

- Fixed price – no extra fees

‘I can e-invoice from Holvi quickly by choosing from my product inventory. Everything works together – payments, invoicing, accounting. And I get notified as soon as the invoice is paid. Clear and simple.’

Albert Virtanen, Marketing Consultant

Why start e-invoicing?

E-invoices are sent electronically in XML (machine-readable) format, saving admin time and eliminating errors. That’s why more and more companies are turning to electronic invoicing to cut down on costs. With Holvi, you can:

- E-invoice Federal Government & public sector clients

- Comply with EU E-invoicing Directive standards

- Use XRechnung or ZUGFeRD e-invoicing formats

- Bypass the ZRE (the Federal Government’s online e-invoicing portal)

E-invoicing is mandatory as of 27 November 2020 when invoicing federal-level public sector clients in amounts over €1,000. Only XRechnung or ZUGFeRD 2.1 formats will be accepted – no more paper or PDF!

E is for easier invoicing

Electronic invoicing is no longer just for big companies. With Holvi’s all-in-one business account, freelancers and traders can now benefit from e-invoicing.

- Send e-invoices with a few clicks

- Straight from your business account

- No separate e-invoicing software

- No mistakes, so you get paid faster

- Instant notifications on inbound payments

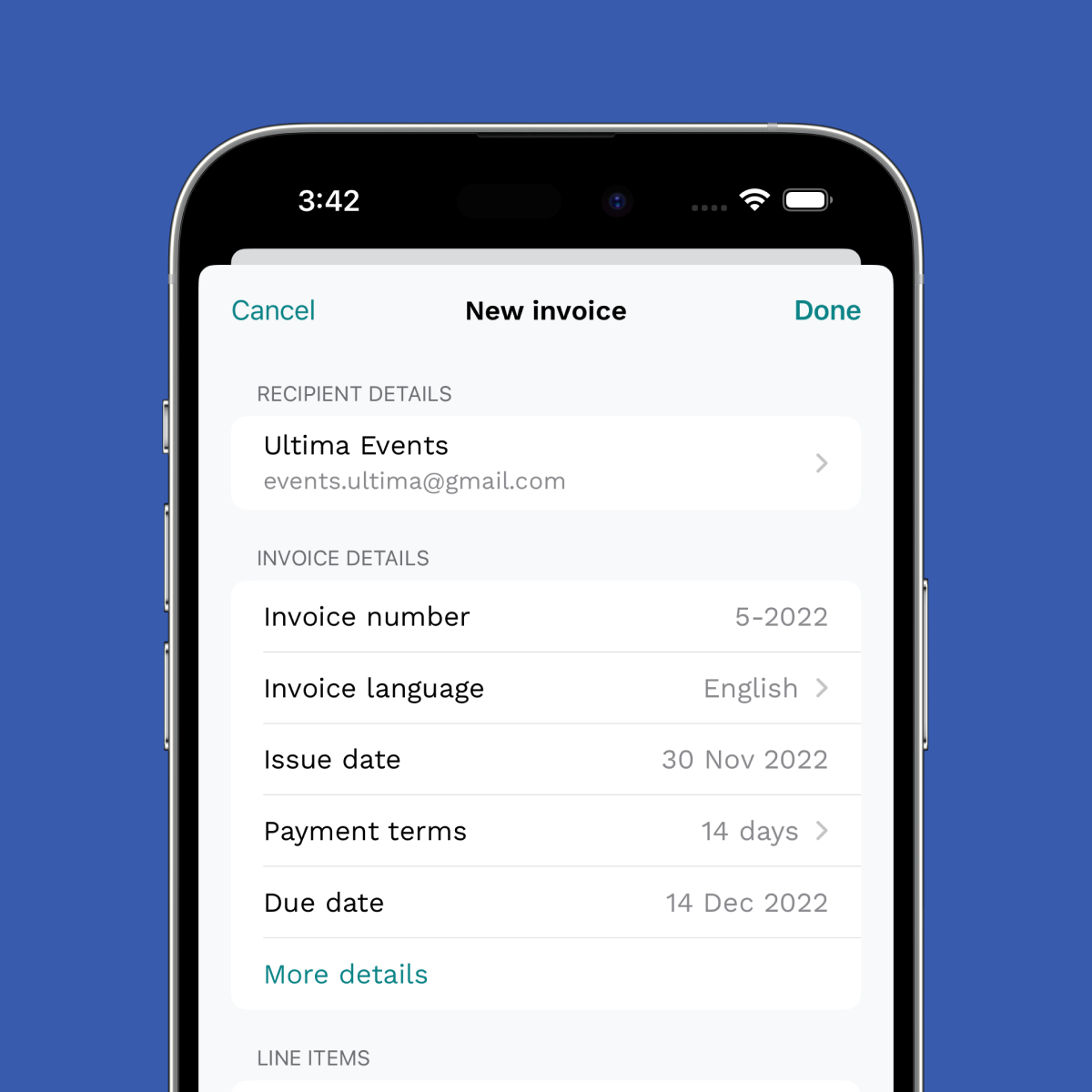

How to create an XRechnung or ZUGFeRD invoice

With Holvi, creating XRechnung or ZUGFeRD e-invoices is just as easy as creating traditional ones. It works like this:

- Create an invoice directly in Holvi

- Select e-invoice as the sending method

- Specify the recipient’s address (Leitweg-ID)

- Tap ‘Send’ and you’re done!

E-invoicing keeps your books up to date

When all your e-invoicing is in your Holvi Pro account, your data syncs to income and expense reports for easy bookkeeping and cash flow control.

- Real-time VAT balance – Holvi’s VAT calculator lets you know what you owe, or what you can claim back!

- 30-day balance forecast – our smart graph shows a balance projection based on upcoming payments in and out

Is Holvi Pro for you?

With Holvi Pro, you can create and send unlimited e-invoices. Everything works together to simplify your work life. If you:

- Want everything in Holvi Lite, plus more

- Need to create and send e-invoices for Federal Government or public sector clients

- Invoice lots of clients each month – unlimited invoicing. Send, receive and track your bills

- Have a team and need more cards – includes up to 3 Holvi Business Mastercards®, and you can add on more

- Benefit from cheaper cash withdrawal – take out cash anywhere in the world at just 2%

- Send e-invoices business to business (B2B)

- Send e-invoices to public sector clients (B2G)

- Create XRechnung or ZUGFeRD invoices

- Create e-invoice to EU E-invoicing Directive standard

- Instant notifications on paid e-invoices

- A 30-day balance forecast shows your future cash flow

- Data syncs automatically to bookkeeping reports

- Your VAT forecast stays up to date

Open an account and start e-invoicing –

as easy as 1, 2, Holvi

1. Hi, nice to meet you!

Share a few details and verify your identity with a quick video call.

2. So what do you do?

Add some company info to help us verify your business.

3. Let’s work together.

Choose the Holvi Pro plan. Start using Holvi e-invoicing to simplify work life.

3-click e-invoicing

3 clicks, that’s all it takes to send an e-invoice.

Time is money

E-invoices are more likely to get you paid on time.

Bank-level security

This means the money you collect from e-invoicing is always protected.

FAQs – Holvi e-invoicing

No, with Holvi Pro you can effectively send unlimited invoices and e-invoices.*

*We draw the line at 500 e-invoices per month in Holvi Pro. After this, there’s a €0.50 charge per e-invoice. (That’s 16.66 e-invoices per day, every day. So far no one has come close to this limit.) See our Fair Use Policy.

No. An electronic invoice contains structured XML data. An ordinary invoice that you send by email as a PDF does not contain XML. The only way to send electronic invoices is with an e-invoice programme, such as the one integrated in your Holvi account.

The requirement to send electronic invoices is based on EU Directive 2014/55/EU. On 4 April 2017, this directive was implemented by the German E-Invoice Act. On 6 September 2017, the E-Invoice Regulation was adopted. Since the Federal Government and the Länder must already receive e-invoices, the obligation for contractors – i.e. companies and self-employed people – will now also come into effect on 27 November 2020. More information can be found in the German government’s FAQs on e-invoice regulation.

No. Whether your invoice recipient uses XRechnung or ZUGFeRD format doesn’t affect you, as the choice of format is made in the background. You simply enter the recipient’s address and click ‘Send’. Everything else takes care of itself.

The ‘X’ in XRechnung stands for the XML data it contains. XML is a machine-readable markup language (Extensible Markup Language).

ZUGFeRD stands for Zentraler User Guide des Forums elektronische Rechnung Deutschland.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi is all you need – from business account, to online invoicing, to online bookkeeping.