Your all-in-one freelancer account

More than just a freelancer bank account. Business banking, expense management, invoicing, bookkeeping and credit cards. All in one place.

- Holvi mobile banking app

- Freelancer debit card

- Manage receipts

- Open account online

The ultimate freelancer account

Stay in control, get down to business

Separate your freelance business from private life with Holvi and keep track of all your payments.

- Open a business account with German IBAN

- Unlimited free transfers in euros

- Business Debit Mastercard®, accepted worldwide

- Manage expenses and save receipts – stay tax ready

- Access via browser or app, with real-time notifications

0 €

Free for 30 days

Biometric login

Fingerprint or Face ID login keeps access to your Holvi account safe.

Bank-level security

Your funds are protected in European partner banks with deposit protection.

Stay notified

Real-time notifications for all account activity – keep track of ins and outs.

Smarter business banking for freelancers

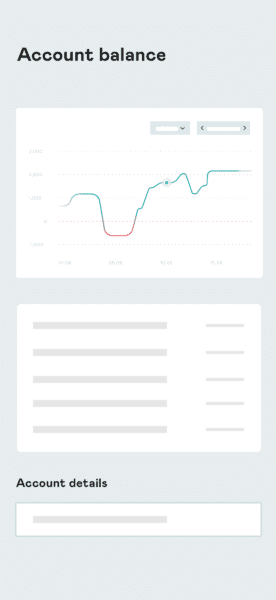

See how much money is yours in real time

Self-employment sometimes means unpredictable income and expenses. With Holvi, you can manage cash flow in real time and see how finances are doing, at a glance.

- VAT calculator: Shows how much you have to save for tax time

- Real-time profit: Shows how much revenue is left after expenses

- Balance forecast: Shows your upcoming balance based on scheduled transactions in and out – so you always stay ahead of the curve

Freelance expense management

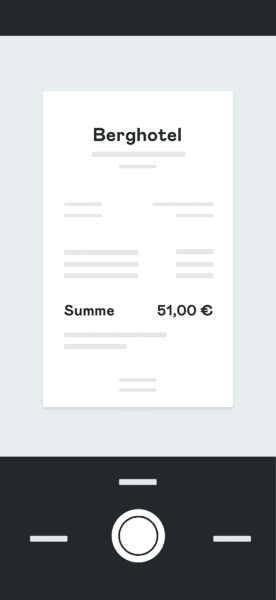

Where’s that receipt again?

Said no Holvi user, ever. Store expense receipts and invoices right in your business account. Calm the chaos of managing expenses.

- Scan receipts on the go using the Holvi app, or upload receipts later at your convenience

- Holvi automatically connects receipts to payments and stores them for tax time and beyond

- Filter transactions to spot transactions any missing receipts

- Download bookkeeping details and attachments anytime, or invite your accountant directly to your Holvi account

Invoice your clients

With Holvi, you can bill clients right in your business account. Send invoices and e-invoices with just a few clicks.

Order team cards

Let your employees pay for expenses and save yourself the hassle of expense reports.

Freelancer tax prep & bookkeeping

Stress-free German tax returns, almost

No more time-consuming receipt sorting at the end of each month. With Holvi, you can prep bookkeeping effortlessly:

- 1. Scan & save receipts

- 2. Add VAT rate

- 3. Categorise transactions

Via the Holvi mobile app or on the computer, bookkeeping with Holvi is so easy you won’t even know you’re doing it.

Upcoming tax return?

Here’s how to handle it with Holvi.

Simply, on Elster

With Holvi’s downloadable reports, filing your tax return on Elster is easy. You have all the data for your VAT advance notification and income surplus invoice (EÜR) at hand.

With a tax advisor

No more paperwork. Send your accounting data to your tax advisor in DATEV format. Or invite your tax advisor to Holvi with limited access – so they see only what’s needed.

Seamlessly, with Lexware Office

Using Lexware Office? You can connect your accounting software to Holvi with just a few clicks. All transactions sync automatically.

Try Holvi Pro – free for 30 days

Check out the Holvi Pro business account with DATEV connection for 30 days, free of charge!

Accounts & cards for freelancers

Holvi Lite

€9 /month + VAT

Get control of your business finances. Manage payments and stay on top of the numbers.

- Business banking

- 1 Business Debit Card

- 1 Virtual Card

- Scan & store receipts

- Real-time profit/loss*

- Real-time VAT balance*

- Apple Pay & Google PayTM

Free for 30 days

Holvi Pro

€15 /month + VAT

Simplify work life. Manage banking, expenses, invoicing and accounting – all in one account.

Everything in Holvi Lite plus:

- 3 Business Debit Cards

- Business Credit Card (apply now)

- 1 Virtual Card

- Unlimited invoicing & e-invoicing

- Payment-to-invoice matching

- Bookkeeping preparation

- Export reports for tax filing

- Accounting integrations – or invite your accountant

- Cheaper ATM & instant top-up fees

FAQs – Holvi’s freelancer business account

No, as a freelancer you’re not required to open a separate business account in Germany. But… we recommend it anyway!

Holvi’s VAT calculator, real-time profit and loss statements and balance forecast give you an accurate and up-to-date overview of your small business finances – so there’s no chance of accidentally spending money that doesn’t belong to you.

Read more about how opening a business account can save you time and money in our Expats in Germany blog article: An expat’s guide to opening a business account.

We can’t say for sure, but most likely it’s possible. However, that doesn’t mean it’s a good idea.

For example, take a look at a recent bank statement. As a rule, private accounts are used for lots of personal transactions. If you add business payments on top of that, it can be difficult to keep track of everything. This can complicate your bookkeeping to an unreasonable degree. You’ll have to dig through countless transactions! Sounds painful.

It’s also worth checking your bank’s T&Cs for specifics on whether they permit business activity in a personal account. Some German banks can be strict about this, as they try to push customers to open a separate business accounts with them.

Once you’ve opened your Holvi freelancer business account, you’ll usually receive your IBAN within one day.* At that point, you can already start using your account. Your Holvi Business Mastercard® should arrive within 10 working days.

*In exceptional cases, it may take a little longer to activate your account.

All you need is a valid ID or passport, and your tax number or VAT ID.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi is all you need – from business account, to online invoicing, to online bookkeeping.