Bookkeeping for all the single workers

Cut out the noise. Manage self-employed income and expense receipts, and prep for Finnish tax returns – all in your business account. Groovy.

- Holvi Business Mastercard®

- Scan & store receipts

- Track VAT and profit in real time

- Export bookkeeping data

We make accounting and taxes

a little less taxing

For self-employed people who do their own Finnish tax returns

For self-employed people with an accountant

For Briox users who want a seamless way to manage finances

Online expense management

Where’s that receipt again?

Said no Holvi user, ever. Store expense receipts and invoices right in your business account. Calm the chaos of managing expenses.

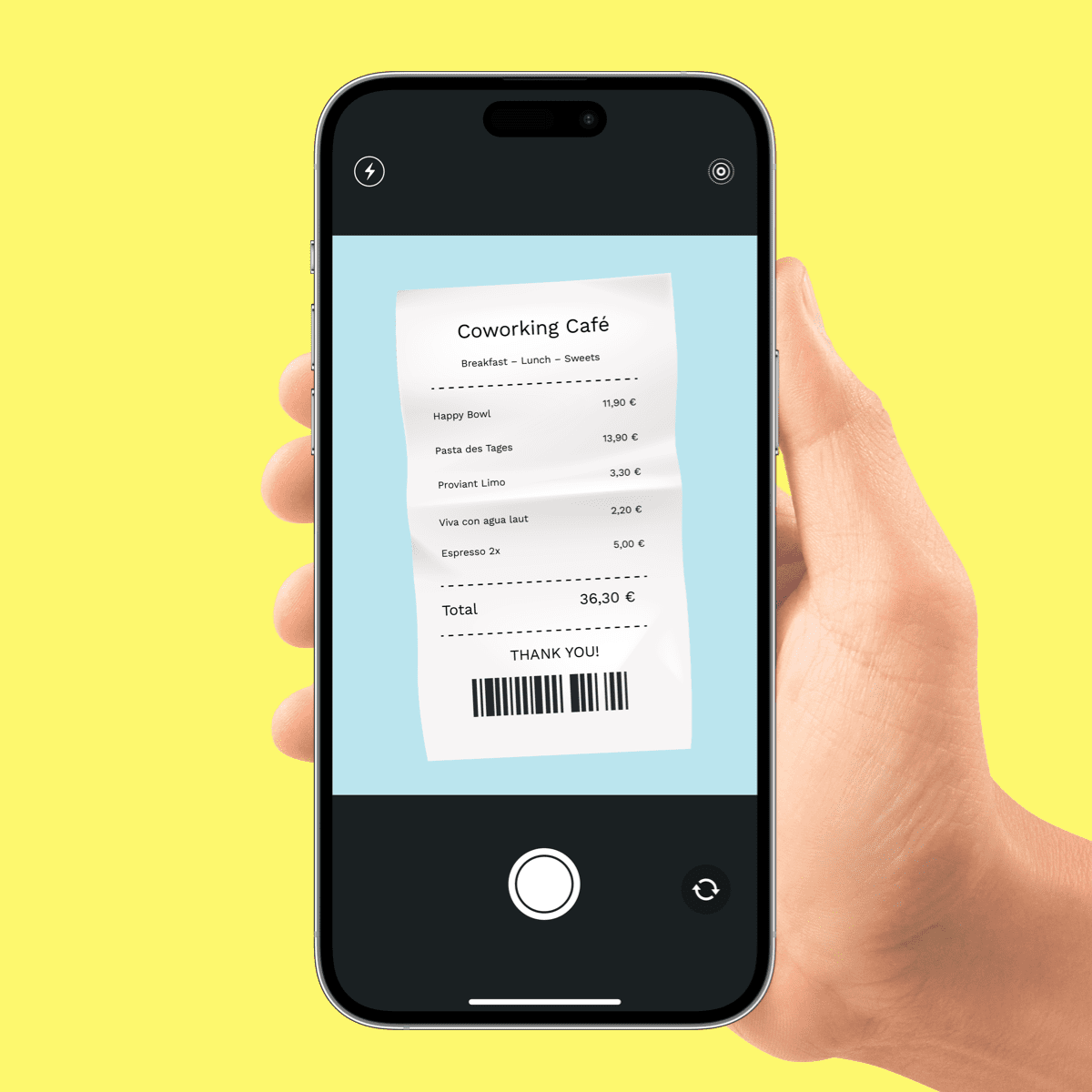

- Scan receipts on the go using the Holvi mobile app, or upload receipts later at your convenience

- Holvi automatically connects receipts to payments and stores them for tax time and beyond

- Download bookkeeping details and attachments anytime, or invite your accountant directly to your Holvi account

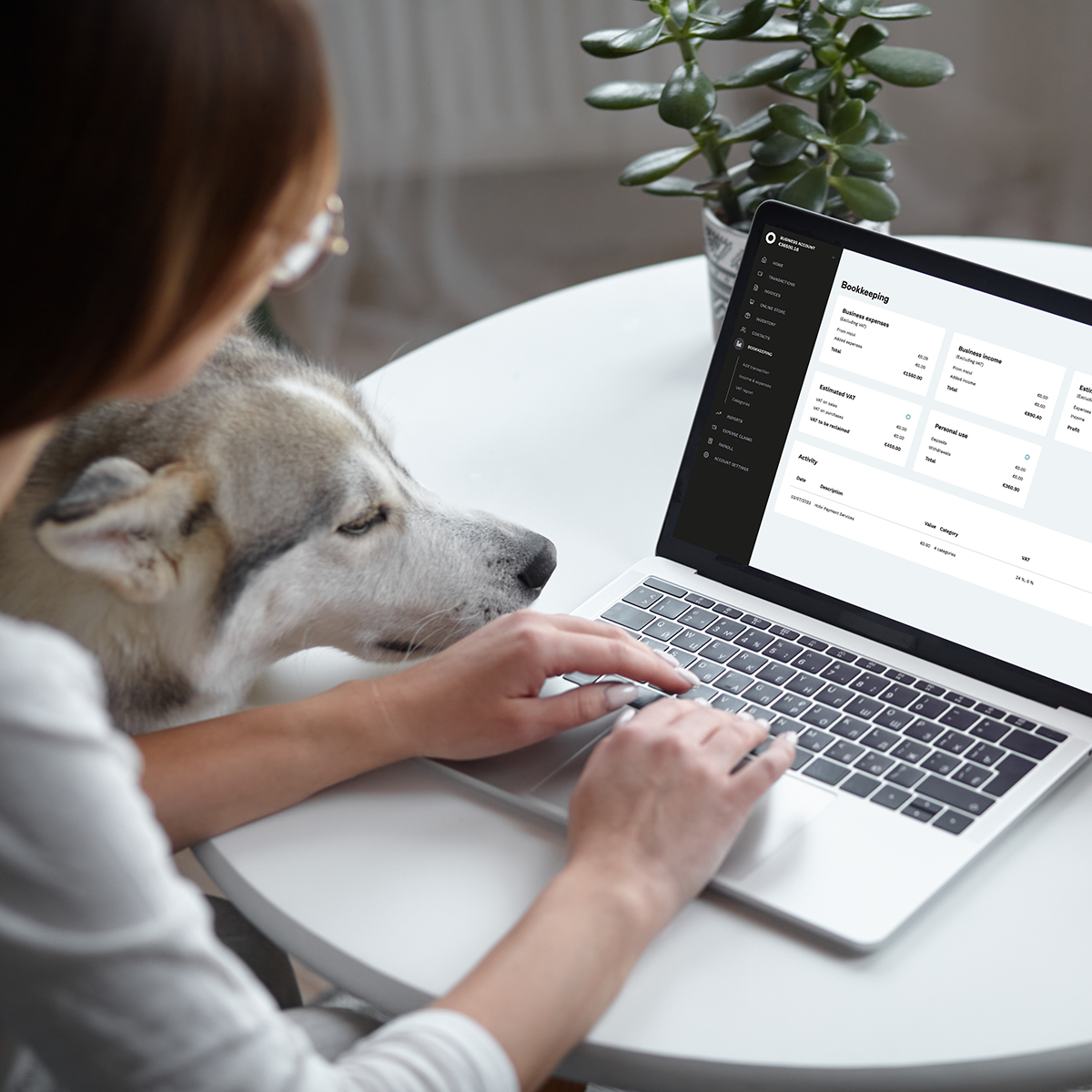

How Holvi online bookkeeping

works for you

Effortless bookkeeping, online or in our mobile app. For wherever work life takes you.

1. Scan & store receipts

Open the notification and scan your receipt after each Holvi Business Mastercard® payment, or upload to Holvi later on.

2. Add VAT rate

Holvi calculates in real time how much VAT you owe the Finnish tax office. No more surprises.

3. Categorise transactions

Create custom income and expense categories, sort payments into categories and prep bookkeeping for tax time.

4. Bookkeeping done!

When it’s time to file your tax return on Vero, you’ll have all the data ready. No more stress at the end of the month!

Tax preparation and bookkeeping

Stress-free Finnish tax returns, almost

Download reports to simplify tax time

Download accounting reports. With all your bookkeeping data prepped to the Finnish standard, filling out tax returns on Vero just got easier. But sadly, we can’t make them disappear entirely.

Share bookkeeping data via Dropbox

Exchanging paper receipts with your accountant can get taxing. Instead, why not export data in XLS or PDF direct to your accountant via Dropbox? Transfer bookkeeping data online – so easy with Holvi.

Bye-bye tax stress, and hello Holvi!

Online banking, invoicing and bookkeeping – all in one place. That’s work life simplified.

Wave so long to tedious end-of-month receipt sorting

All your bookkeeping data in one place, together with the rest of your business

Do your books on the go with Holvi’s mobile app – anytime, anywhere

Accounting software integration

Or connect your accounting software

- Connect Holvi to Briox with just a few clicks

- Pay expenses with your Holvi Business Mastercard®

- All transactions auto-sync to your accounting software

- Handle bookkeeping and tax returns in Briox

*More English accounting software integrations coming soon!

Open an account online –

as easy as 1, 2, Holvi

1. Hi, nice to meet you!

Share a few details and verify your identity with your bank credentials.

2. So what do you do?

Add some company info to help us verify your business.

3. Let’s work together.

Choose your pricing plan. Start using Holvi to simplify work life.

FAQs – Holvi online bookkeeping

With Holvi Pro you can also add external transactions, such as cash payments. This way you can still do all your bookkeeping in Holvi, even if not all transactions aren’t made using your Holvi Business Mastercard® – although really, it’s much easier when everything is all in one place.

Choose any date range on your Holvi reports. You can download them in XLS or PDF and send via email or Dropbox. Here are the reports we offer:

- Income statement: Total income, expenses and their sum (net income).

- Budget report: A breakdown of your income and expense categories, including their transactions and total amounts.

- Invoicing report: A full list of your invoices, including issue date, due date, payment date and VAT.

- Accounting journal: A list of every transaction in your account, including date, type, VAT%, category and other important information (accrual/cash based).

- General ledger: A breakdown of your income and expense categories and transactions they contain, including date, type, VAT%, category and other important information (cash based).

- VAT report (if your account is VAT liable): A list of transactions that include VAT, organised by their VAT% (cash based).

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.