Open a founder business account

Are you starting a GmbH or UG in Germany? Open your business account, transfer your share capital and get up and running in just a few days.

- Open founder account online

- Deposit share capital

- Smart banking & cards

- Easy accounting

Your founder account for fast company formation

- Open account online – no bank appointment needed

- Deposit share capital – via instant transfer

- Bank statement – download instantly as proof of entry in the commercial register

- Optional: Digital express company formation from €99

See what our customers have to say

Deposit share capital, without bank appointment

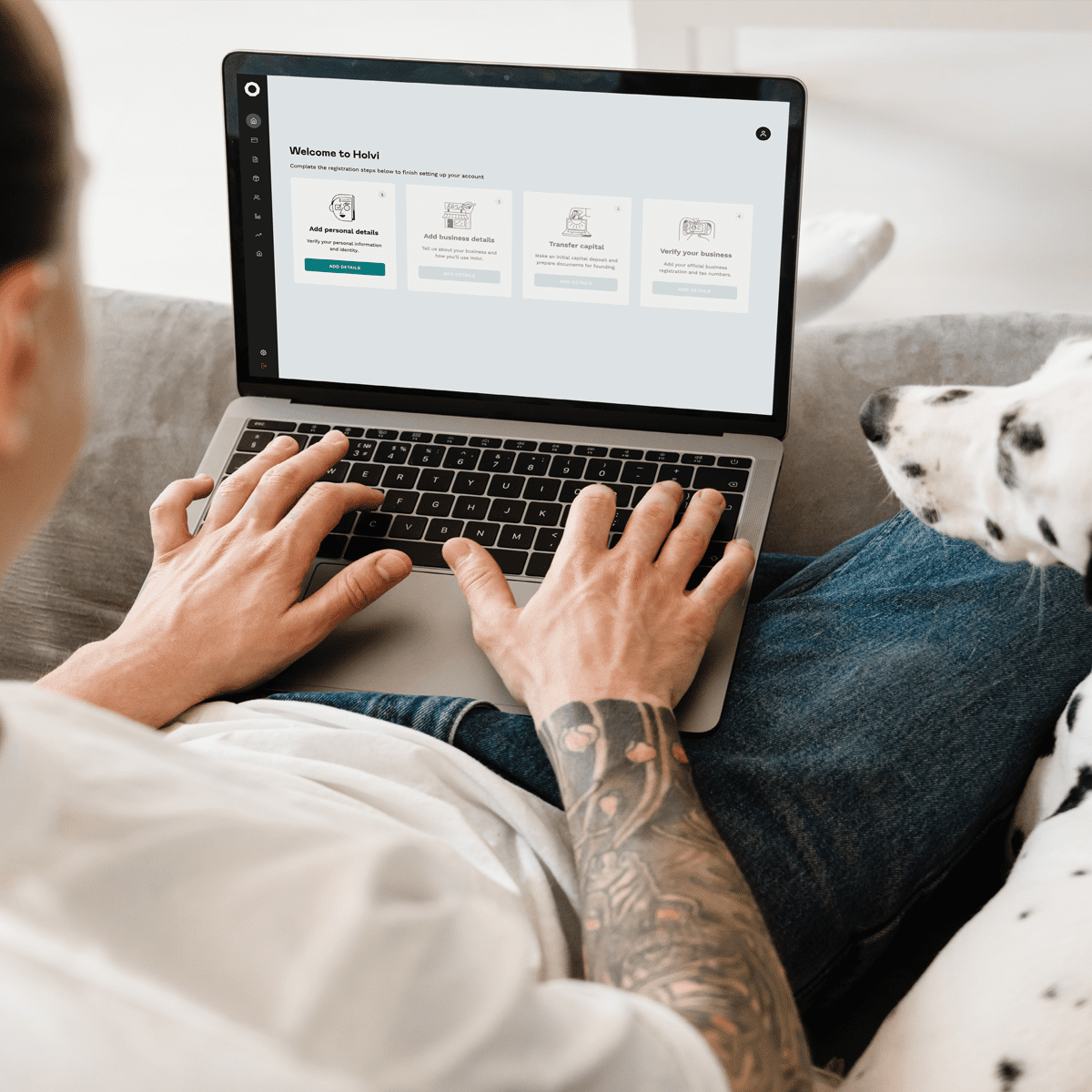

1. Set up your limited company

Found your temporary GmbH or UG at the notary office – easiest with our formation packages.

2. Open your Holvi business account

Open your account and upload the necessary documents. You can open a Holvi business account in just 3 steps.

3. Transfer your share capital

Transfer your share capital. Submit your account statement to your notary to finalise the founding process.

4. Activate your business account

Enter your company in the trade registry and upload the registry extract to your Holvi account – we do the rest.

GmbH/UG business account

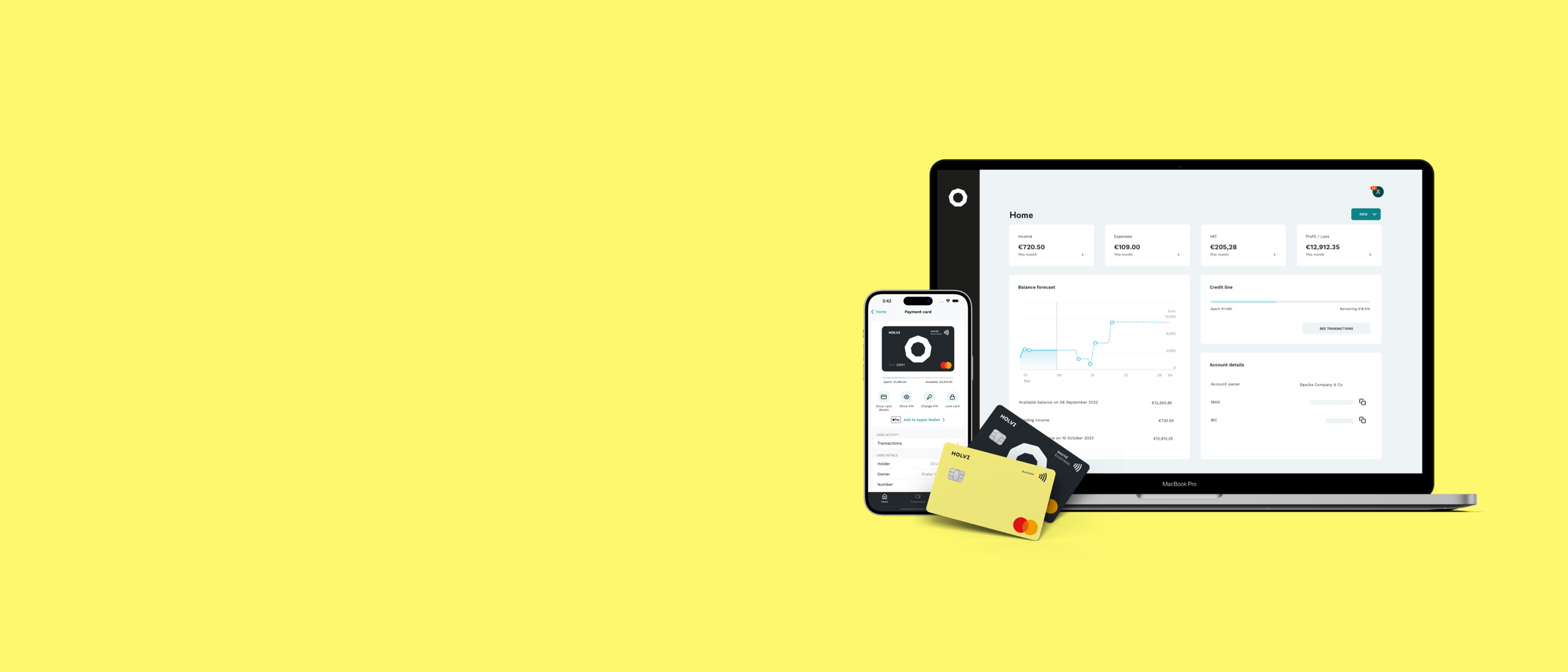

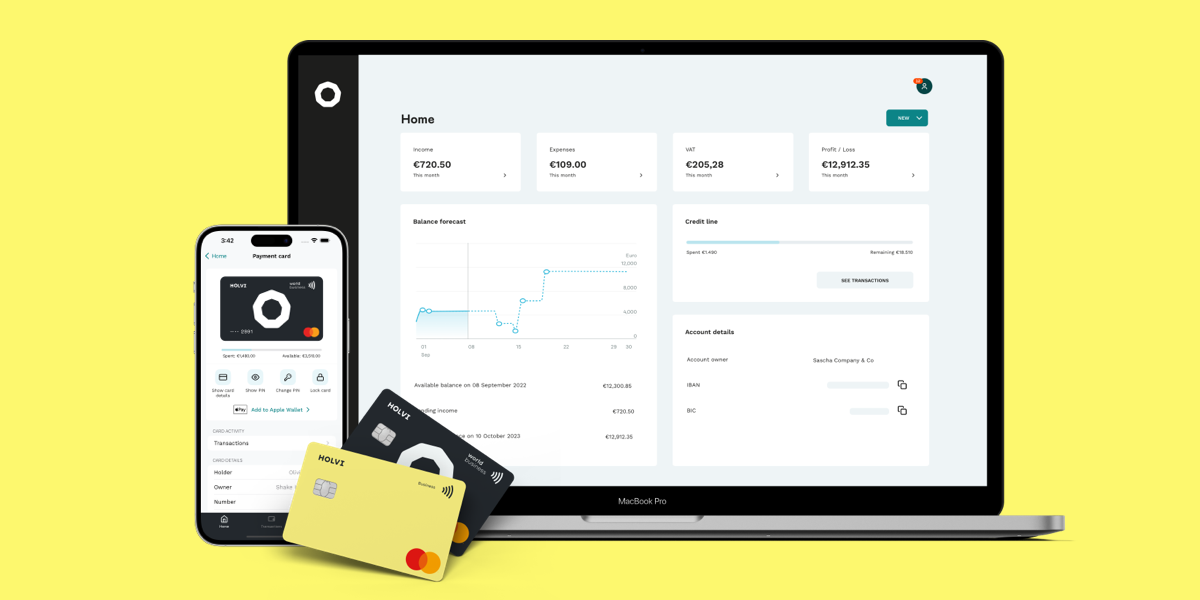

Home for your business finances

With Holvi, you get more than just a business account. Business banking, expense management and smart payment cards – all in one account.

- German IBAN & BIC

- International transfers in 18 currencies

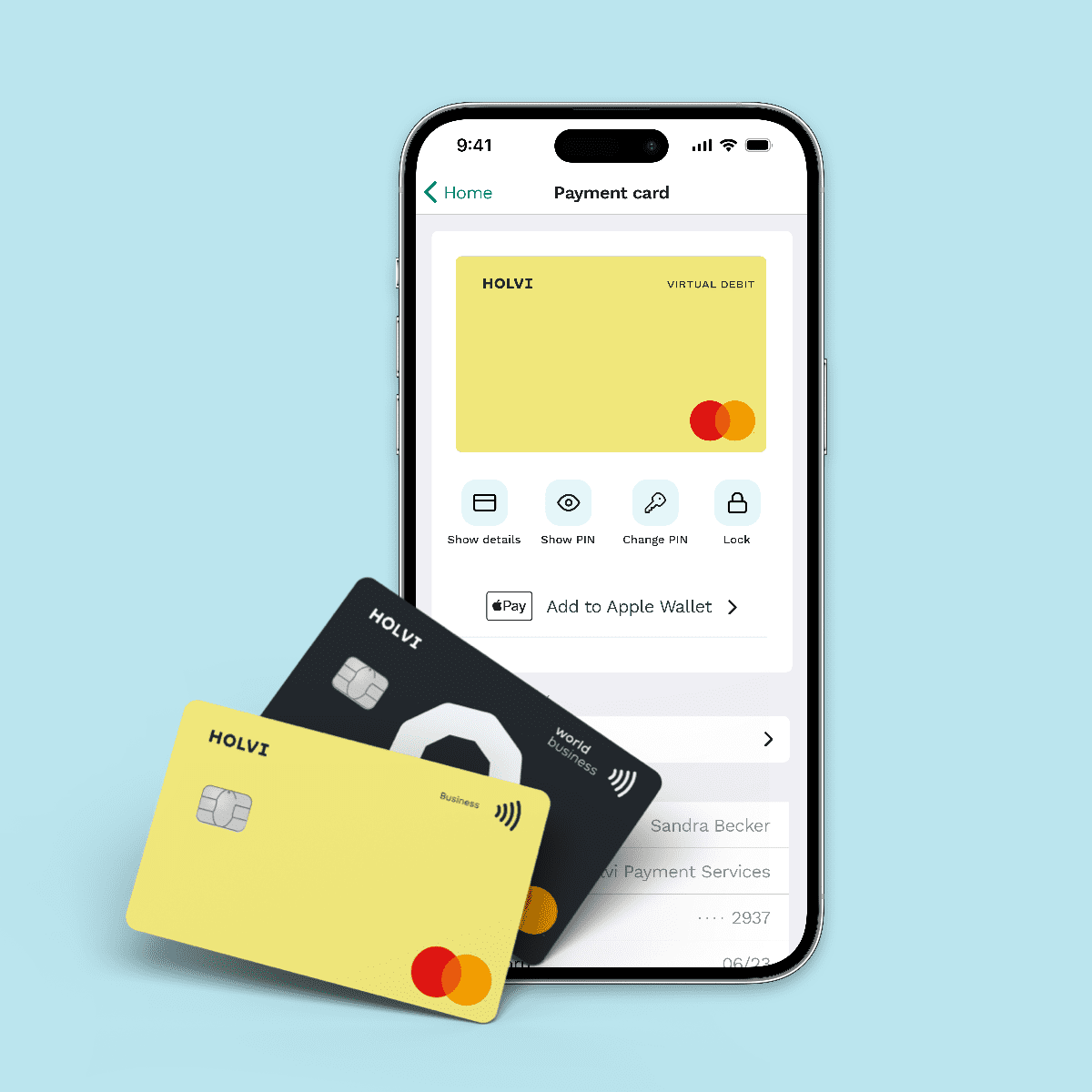

- Debit, credit and virtual cards

- Apple Pay & Google Pay™

- Add users and manage their access rights

- Bank-level security

Tidy books & easy tax prep

Manage receipts, invoicing & bookkeeping

Keep your books tidy and stay in the know. Manage your cash flow in real time and see how your finances are doing, at a glance.

- Online invoicing that gets you paid fast

- Scan and save your receipts

- Categorise income and expenses

- VAT calculator that shows how much you have to save for tax time

- Download reports & account statements

- Invite your accountant

- Lexware Office Connection manage all things banking and bookkeeping in one place

- DATEV Connection for simplified collaboration with your tax consultancy

Accounting connections

Save time on accounting

Holvi works with the leading accounting tools. Easily connect your account with your preferred accounting software or your tax advisor.

- DATEV Connection: Synchronise transactions with your tax advisor or book yourself with DATEV Unternehmen Online.

- Lexware Office connection: Connect Lexware Office (formerly lexoffice) with Holvi and handle your accounting and annual financial statements yourself.

- Compatible with leading tools: sevDesk, BuchhaltungsButler, and many more.

Founder accounts for your GmbH or UG

Holvi Flex

0 €

0 €

/monthBilled monthly

Only available as a monthly plan

The business account with essential payment features. Pay only for what you need and stay flexible.

Banking and cards

Create additional IBANs (max. 10) for €2/month each.

Pay online and with Apple Pay and Google Pay – also in store. Classic cards €3/month each.

(by application)

Incoming and outgoing regular and instant SEPA transfers.

Send and receive payments in 18 currencies – without the need for third-party providers.

The investment offering is currently only available for GmbHs and UGs

Invoicing

Expenses and bookkeeping

A direct line to your tax office: Connect Holvi with DATEV via a secure EBICS connection and automate your accounting and payment processes. €3 / month.

As a PDF, .xslx, or as an electronic bank statement in camt.052 format.

Holvi Lite

9 € 4,5 €

9 €

/month + VATBilled monthly

1 year subscription, monthly billing

Everything from Holvi Flex, plus more IBANs, more cards, transactions and expense management.

Banking and cards

Up to 2 German IBANs (country code DE) included. Create additional IBANs (max. 10) for €1 / month each.

All cards work with Apple Pay and Google Pay.

(By application)

Manage transfers in-app. Transfers and direct debits beyond those included in your plan are charged at €0.25 per transfer. Incoming and outgoing regular and instant SEPA transfers

Send and receive payments in 18 currencies – without the need for third-party providers.

The investment offering is currently only available for GmbHs and UGs.

Invoicing

Upload received e-invoices to check, pay and archive them in a legally compliant way.

Expenses and bookkeeping

A direct line to your tax office: Connect Holvi with DATEV via a secure EBICS connection and automate your accounting and payment processes. €3 / month.

Connect Holvi with Lexware Office bookkeeping software, automatically synchronise your transactions and simplify bookkeeping.

Photograph and save receipts using the app, prepare accounting with categories and notes.

Standard reports: Account statement, accounting journal, general ledger, order lists.

Holvi Pro

15 € 9 €

15 €

/month + VATBilled monthly

1 year subscription, monthly billing

Everything from Holvi Lite, plus more payment cards, e-invoicing and advanced accounting features.

Banking and cards

Up to 5 German IBANs (country code DE) included. Create additional IBANs (max. 10) for €1 / month each.

All cards work with Apple Pay and Google Pay.

(By application)

Get a free credit card with up to €50,000 credit limit. €0 fees, 0% interest on end-of-month repayments. Other repayment options available for an additional fee.

Send and receive payments in 18 currencies – without the need for third-party providers.

The investment offering is currently only available for GmbHs and UGs.

Invoicing

Upload received e-invoices to check, pay and archive them in a legally compliant way.

Create, send and track invoices and e-invoices (XRechnung/ZUGFeRD).

Expenses and bookkeeping

A direct line to your tax office: Connect Holvi with DATEV via a secure EBICS connection and automate your accounting and payment processes. €3 / month.

Connect Holvi with Lexware Office bookkeeping software, automatically synchronise your transactions and simplify bookkeeping.

Photograph and save receipts using the app, prepare accounting with categories and notes.

Standard reports: Account statement, accounting journal, general ledger, order lists. Advanced reports: VAT report, Income statement, Invoicing report, electronic account statement (camt.052). Plus DATEV payments and bookkeeping reports.

A clear view of your VAT balance in real-time.

Holvi Business

69 € 59 €

69 €

/month + VATBilled monthly

1 year subscription, monthly billing

For GmbHs and UGs with multiple employees, budgets and monthly financial tasks.

Banking and cards

Up to 15 German IBANs with country code DE included. Additional IBANs €1/month each.

All cards work with Apple Pay and Google Pay.

(By application)

Free credit card with up to €50,000 credit limit.

Send and receive payments in 18 currencies – without third-party tools.

The investment offering is currently only available for GmbHs and UGs.

Invoicing

Upload received e-invoices to check, pay and archive them in a legally compliant way.

Create, send and track invoices and e-invoices (XRechnung/ZUGFeRD).

Expenses and bookkeeping

Connect Holvi with DATEV via a secure EBICS connection. Automate your accounting and payment processes.

Connect Holvi with Lexware Office bookkeeping software. Automatically sync transactions and simplify bookkeeping.

Photograph and save receipts using the app, prepare accounting with categories and notes.

Standard reports: Bank statement, accounting journal, general ledger, order overviews. Advanced exports and reports: Sales tax report, revenue report, invoice report, electronic bank statement (camt.052), DATEV payment report, and DATEV accounting report.

Calculate the VAT balance in real time.

FAQs – Holvi’s founder account

No, unfortunately, this is not possible. To open a business account and to transfer your share capital, we first need your signed and certified founding documents.

You will only gain full access to your business account after you enter your company in the trade registry (Handelsregister) and upload the registry extract (Handelsregisterauszug).

During the founding phase, these are the limitations that apply to your business account:

- You can only use the account for payments directly related to founding your company (e.g. payment made to a notary).

- Incoming payments, except the share capital transfers, will be rejected.

- Your account will be closed immediately if the IBAN is used for any unrelated activities – for example, incoming payments, direct debit, etc.

Read more about opening a Holvi founder account in our help centre.

To open a founder account, choose the business type UG i.G. or GmbH i.G.

‘i.G.’ means “in Gründung”, which in English translates to “in founding”.

We do not accept external payments on behalf of another.

Holvi only accepts transfers from shareholders. Each share capital transfer must originate from an account under that specific shareholder’s name.

During the founding phase, the shareholders are personally liable. The liability risk applies until the share capital is transferred and the GmbH or UG is entered into the trade registry.

Fast company formation reduces your liability risk. With Holvi, you can complete all the necessary steps online and the founding process within days.

Once you have set up your temporary GmbH or UG at the notary office, you can open your founder account online in minutes.