Your free Business Credit Card

With Holvi’s credit card for the self-employed, you can optimise your cash flow. €0 fees, 0% interest when repaid at the end of the month!

New customers can apply for a Holvi credit card once the business demonstrates an active business history of at least four (4) months. This can be shown via your Holvi business account or an external account using Open Banking.

Holvi Business Credit Card

More flexibility for your business expenses

Simply pay by credit card and pay back at the end of the month – or choose a repayment option. Your cash flow will thank you.

- Business credit card – with credit line up to €50,000

- Pay worldwide – wherever Mastercard® is accepted

- Highest level of acceptance – for SaaS subscriptions, car rentals and hotel bookings

- Secure online payments – backed by Mastercard® 3D-Secure and Holvi’s bank-level security

€0 fees, 0% interest.

Repayment at the end of the month. The cheapest option for the Holvi Business Credit Card.

- Up to €50,000 credit limit – for your business expenses.

- €0 monthly fee – no hidden costs.

- 0% interest – repayment at the end of the month.

- Optional payment deferral: repayment 1 month later at a fair interest rate of 16%.

Credit card for your business

The credit card made for small businesses and the self-employed.

Affordable

€0 fees, 0% interest when repaid at the end of the month.

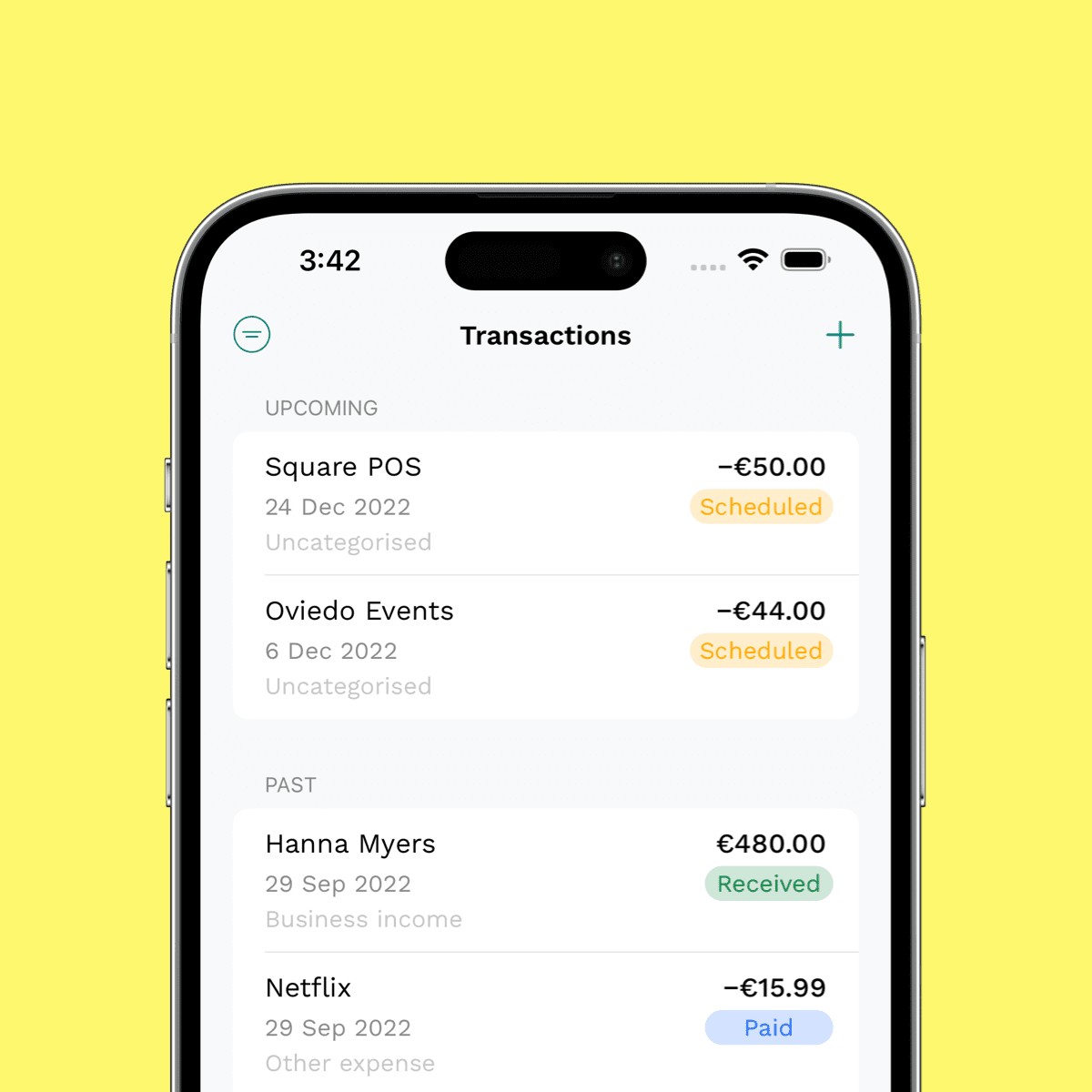

Monthly billing

You’ll get a monthly credit card statement with your repayment amount and any interest.

Highest security

Biometric login and bank-level security.

As requested: even more financial flexibility.

For larger purchases, choose one of the installment payment options from 3 to 12 months. Predictable costs, clear repayment structure.

Repay in 3 instalments

€3 per month card fee*

- Pay back this month’s expenses in 3 monthly instalments starting next month

- Or you can pay back in this month – interest-free

- 16% interest rate

- Credit limit of up to €50,000

- Virtual and physical card included

Repay in 6 instalments

€6 per month card fee*

- Pay back this month’s expenses in 6 monthly instalments starting next month

- Or you can pay back in this month – interest-free

- 16% interest rate

- Credit limit of up to €50,000

- Virtual and physical card included

Repay in 12 instalments

€12 per month card fee*

- Pay back this month’s expenses in 12 monthly installments starting next month

- Or you can pay back in this month – interest-free

- 16% interest rate

- Credit limit of up to €50,000

- Virtual and physical card included

* Only available on our Holvi Pro pricing plan. Credit card fees are billed separately, in addition to the cost of Holvi Pro. New customers can apply for a Holvi credit card at the earliest 3 months after opening a Holvi business account.

When is it worth paying in installments?

✔️ Invest in your business

Fund projects you can’t afford upfront. Cover urgent expenses – like that new software licence you need for ongoing work.

✔️ Cover payment gaps

Fluctuating income? Clients paying late? Bridge payment gaps and keep business running smoothly.

✔️ Split larger expenses

Big purchases can put a dent in your cash flow. Split them into manageable instalments, and pay them off over time.

✔️ Buy time

With credit card transactions due at the end of next month, you have ample time to budget.

Apple Pay & Google Pay

Fast and easy card-free payments

Now you can enjoy all the benefits of your Holvi card using Apple Pay or Google Pay™️. The fast, easy and secure way to pay in stores, apps and online with just a touch or a glance.

All payment cards

Discover more Holvi payment features:

- Debit cards

- Virtual card

- Apple Pay & Google Pay™️

- Accounting integration

Top-security credit card

& business banking

Secure login and online card payments with 2FA and Mastercard® Identity Check™.

As a licenced payment institution, we follow the same strict security rules as a bank.

Lock and unlock cards in-app, get notified the moment a payment goes through.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi is all you need – from business account, to online invoicing, to online bookkeeping.