Not your ordinary business account

A business account that grows with you – open several IBAN accounts for your company’s needs. You can even open them from the comfort of your sofa at home.

- Up to 10 IBAN accounts

- Send and receive instant transfers

- Debit, credit and virtual cards

- 100% online

Corporate account

All-in-one business account

It all starts here. Business banking, invoicing, expense management and tax prep – all in one account.

- Open several IBAN accounts in your Holvi profile for different purposes, such as VAT settlements, savings or daily expenses and add cards to your accounts.

- Send and receive instant payments in the SEPA area

- Smart payment cards – virtual, debit and credit cards

- Expense management and receipt storage

- Add users and manage their access rights

- Invite your accountant

- Download reports & account statements

- Boost sales with your own online store

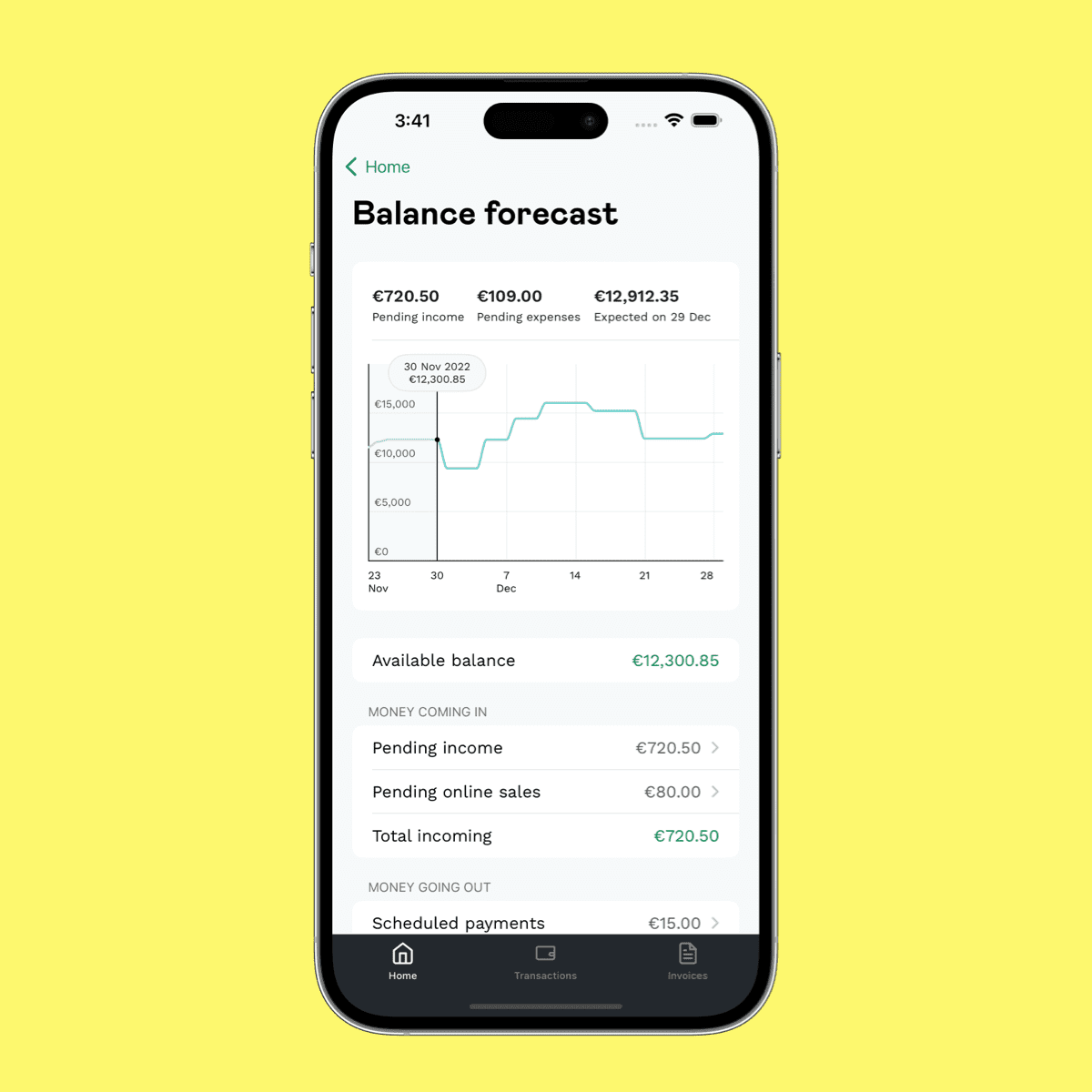

Cash flow management

Track your money in real time

With Holvi, you can manage cash flow in real time and see how your finances are doing, at a glance.

- VAT calculator: Uses your income and expenses to calculate how much you need to save for tax time

- Invoicing & e-invoicing: Create and send invoices easily from your business account. Get notified the moment you get paid.

- Real-time profit: Shows how much revenue is left over after expenses, helping you manage costs

- Balance forecast: Shows your upcoming balance based on scheduled transactions – so you stay ahead of the curve

Top-security business banking

Account security is our top priority

Holvi has implemented various technical and organizational measures to keep your money, account, and business information safe.

- Holvi account supports Multi-Factor Authentication (MFA)

- Push notifications that notify you about all card activities

- 2-fold security for online payments – backed by Mastercard® 3D-Secure

- Lock and unlock your card whenever necessary, using your Holvi app

- Forgot your PIN? See it in the Holvi app

Effortless interest-bearing account

No fixed terms, no deposit limits. Move your money as often as you like – interest is calculated daily based on your lowest balance and paid out monthly. Earn 1.5% interest until 30.6.2026 and 1% after that. See full terms here.

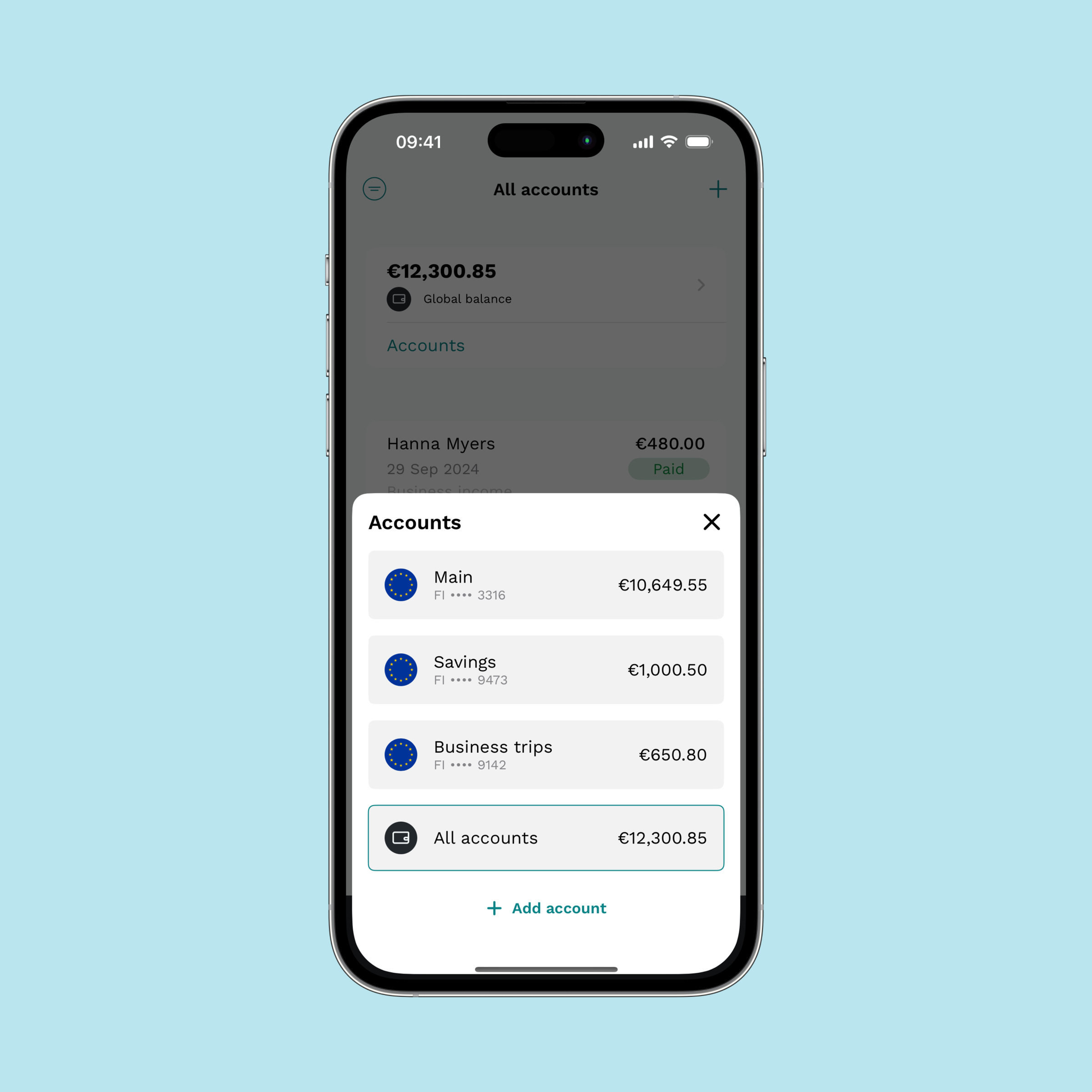

Additional accountsYour finances, organised

Create your own IBAN accounts for different projects, sources of income or VAT payments. With the help of additional accounts and cards, you keep your finances even better under control.

Open your business account in 3 easy steps

Open your business account from the comfort of your home. Holvi is 100% online.

1. Confirm your identity online

2. Fill in your company information

3. Choose your plan

Clear and simple pricing

Holvi Flex

€0

monthFor sole traders and limited companies

Our lightest plan that includes an account and a virtual card. Pay only for the transfers you need and stay flexible. Suitable for new businesses and solopreneurs.

Holvi Lite

€9

month + VATFor sole traders and limited companies

The basic account plan you need to run your daily business banking – without any surprise fees. Suitable for solopreneurs.

Holvi Pro

€15

month + VATFor sole traders and limited companies

Everything you need to run your business: accounts, payment cards, invoicing. Suitable for solopreneurs and small teams.

Holvi Business

€50

month + VATFor SMEs

Save on Ltd’s banking. Affordable SEPA and international transfers, and cards. Suitable as a company’s main or secondary account.

Holvi Zen

€29,90

month + VATFor sole traders

Single-entry bookkeeping, accounts, cards, invoicing and online store.

Holvi Zen+

€79,90

month + VATFor sole traders and limited companies

Double-entry bookkeeping, accounts, cards, invoicing and online store.

Associations Flex

€0

/monthly + VATOur lightest plan that includes an account and a virtual card. Pay only for the transfers your association needs and stay flexible.

Associations Pro

€15

/monthly + VATEverything you need to run your association: accounts, payment cards, invoicing and online store. Collect membership fees and raise funds easily.

FAQ – Holvi business account

You can send money via SEPA transfer in euros. You can also send invoices and e-invoices directly from your Holvi account. If you want, you can also set up a Holvi online store to start selling online. To accept card payments you can connect your account to payment terminals like SumUp.

All pricing plans include the following:

- A free virtual card

- A Holvi Debit Card

You can apply for the Holvi Business Credit Card for even more financial freedom. This lets you cover short-term cash flow gaps and invest in your business.

To open a Holvi business account, you need:

- Name and address

- Name, industry and location of your company

- E-mail address and phone number

- Bank ID or Mobile ID

- A Smartphone

- An estimation of your annual turnover

- Information about the ownership of your company

Here you can find Holvi’s step-by-step guide to verification

Holvi Association now includes 2 IBAN accounts

Holvi Lite now includes 2 IBAN accounts

Holvi Pro now includes 5 IBAN accounts

Holvi Zen now includes 2 IBAN accounts

Holvi Zen+ now includes 5 IBAN accounts

Each additional account not included in the pricing model costs €1/month. You can add a maximum of 10 IBAN accounts to your company.