Guide to Holvi Business Credit Card

How does your Holvi credit card work?

Find out how instalments and interest are calculated, and how you can use your Holvi credit card to stay in control of cashflow.

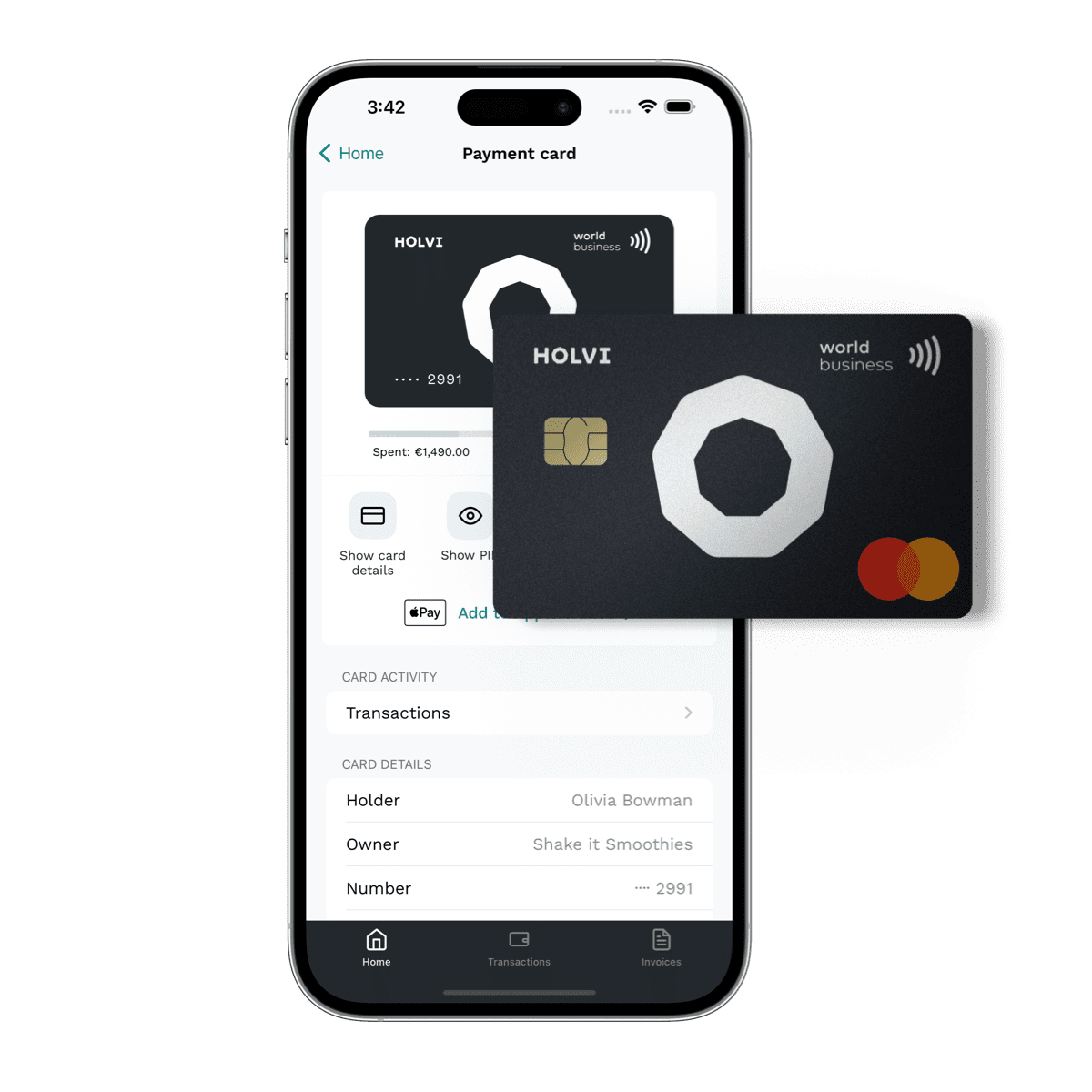

Intro: Our hybrid credit model

What kind of credit card is it?

Old school credit cards try to catch customers in nasty debt traps by offering high interest rates paired with small minimum payments that stretch on foreeeever. We do it differently.

Holvi credit cards let you borrow money and repay it in monthly instalments, so you’re guaranteed to be debt-free before long – in 6 months at most!

Our card also comes with a credit line of up to €5,000. Whenever you repay your credit balance, the amount you paid off becomes available again, giving you the benefits of a revolving credit offering.

We pair the best parts of two credit card types

– instalment credit and revolving credit –

to offer you a credit card that works hard for your business.

Holvi instalment plans

What is an instalment plan?

Another way to think of an instalment plan is as the ‘terms of your loan‘.

Say you’re on a 3-month instalment plan. You’ll pay off monthly spending in 3 evenly shared monthly instalments, starting in the next month. This gives you a total loan term of 90 days.

Each month, we calculate and charge your minimum payment. That’s the smallest amount you can repay each month while staying in good credit standing.

Repaying your credit balance

What is a minimum payment?

Say goodbye to debt traps from traditional credit cards, and hello to a Holvi instalment credit card.

Each month, we calculate your minimum payment as your total monthly spending divided by the number of instalments in your plan – so 1, 3 or 6.

Easy, right?

How to pay your

credit card invoice

in the Holvi app

Turn on auto payments

Did you know you can automatically pay your Holvi credit card invoice, so you never miss a due date?

- Log in at Holvi.com

- Go to Credit cards > Settings

- Manage automatic payments

- We’ll introduce new auto-pay options soon

Confirm draft payment

When your invoice arrives, we’ll draft a minimum payment and notify you via push. Simply confirm it to pay.

- We’ll create a draft payment for you

- Tap the notification to open it

- Confirm the amount and date

- Confirm the payment to clear your balance for the month

View invoices in Holvi

View all your credit card invoices in one place. Check a payment breakdown and pay off your invoice.

- Log in at Holvi.com

- Go to Credit cards > Plan & billing

- Click on an invoice to view details

- Or click Pay now or schedule to pay the invoice

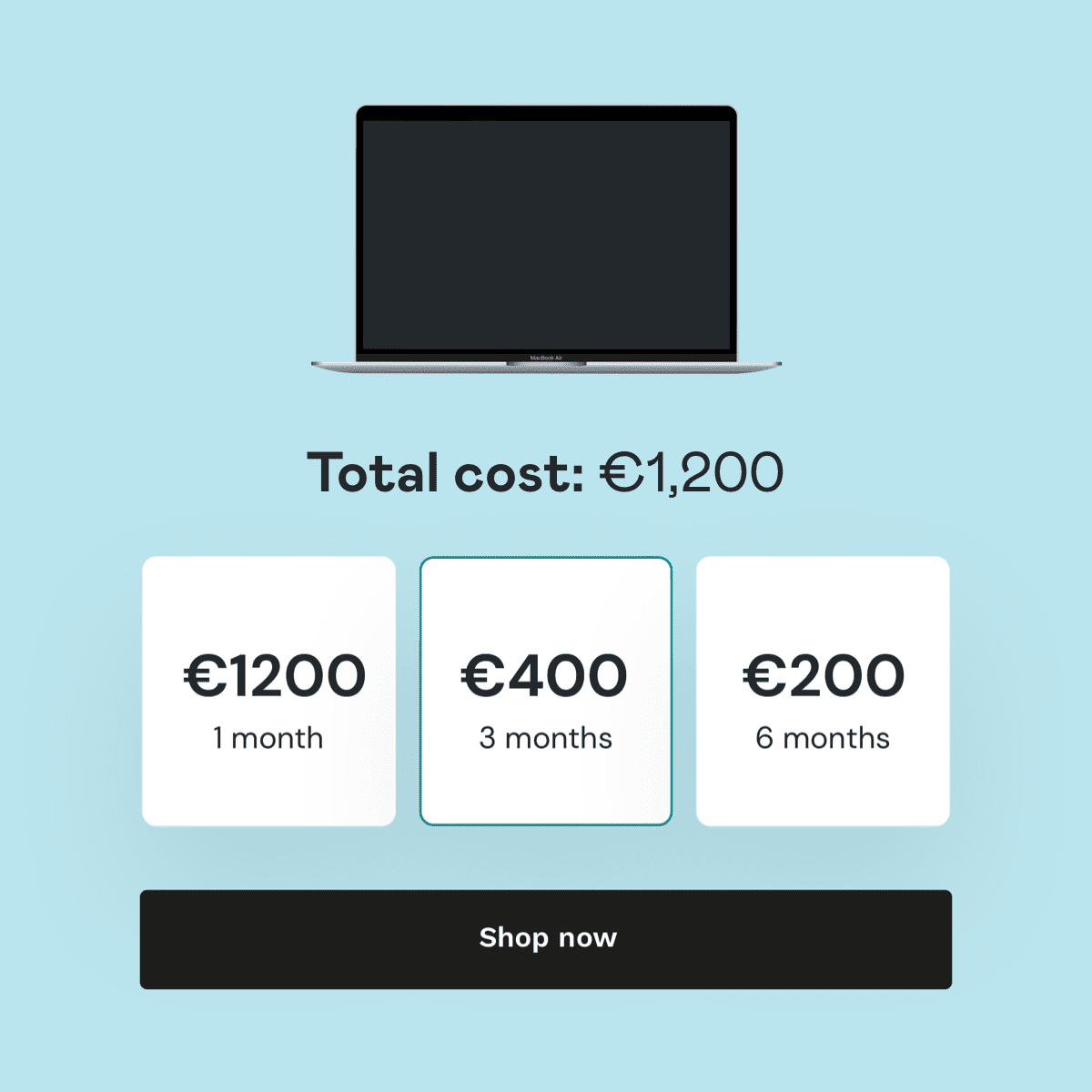

Which instalment plan are you on?

Choose your plan to learn how it works.

1-month instalment plan

€6 per month card fee*

- Cover payment gaps

- Buy yourself time and pay back this month’s expenses at the end of next month

3-month instalment plan

€9 per month card fee*

- Split larger expenses

- Pay back this month’s expenses in 3 monthly instalments starting next month

6-month instalment plan

€12 per month card fee*

- For maximum flexibility

- Pay back this month’s expenses in 6 monthly instalments starting next month

* Card fees are charged monthly, even if you don’t use your card – but we think you will!

Yes! You can pay off your balance early

Or pay interest-free

No matter which plan you choose, you can always pay back your full balance before the first invoice is issued, 100% interest-free. You can also pay back any amount in between your minimum monthly payment and the full balance, at any time.

We’ll never lock you into holding a credit balance longer than you want.

How it works

with card fees and interest

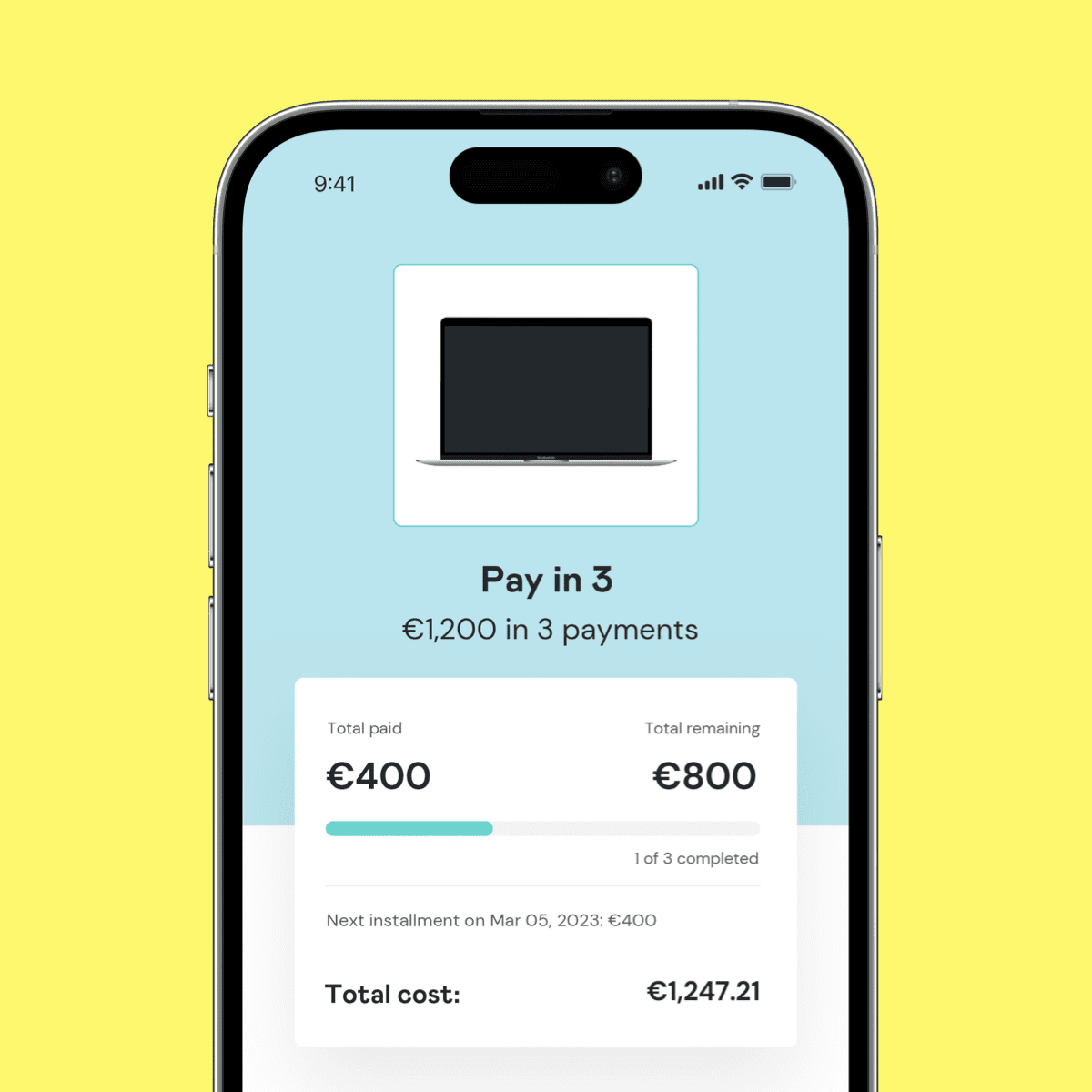

Representative example: 3-month instalment plan

Let’s go back to our laptop example. Imagine you’re on a 3-month instalment plan at 10% APR1.

In January you buy a laptop for €1,200.

1st invoice: February

Instalment: €400 (€1,200 / 3 months)

Interest: €10.33 (1,200 x 10% x 0.0862)

Card fee: €9

Total: €419.33

2nd invoice: March

Instalment: €400 (€1,200 / 3 months)

Interest: €6.44 (800 x 10% x 0.0802)

Card fee: €9

Total: €415.44

3rd invoice: April

Instalment: €400 (€1,200 / 3 months)

Interest: €3.44 (400 x 10% x 0.0862)

Card fee: €9

Total: €412.44

1. Annualised Percentage Rate is your interest rate for an entire year

2. What’s this number? View how we calculate interest here

Summary

Your laptop will be paid off by the end of April with the following breakdown:

| Purchase: | €1,200 |

| Interest: | €20.21 |

| Card fees: | €27 |

| Total: | €1,247.21 |

1-month and 6-month instalment plans work similarly, except:

- You’ll repay spending in even monthly instalments over 1 or 6 months, as per your plan

- Credit card fees vary per instalment plan

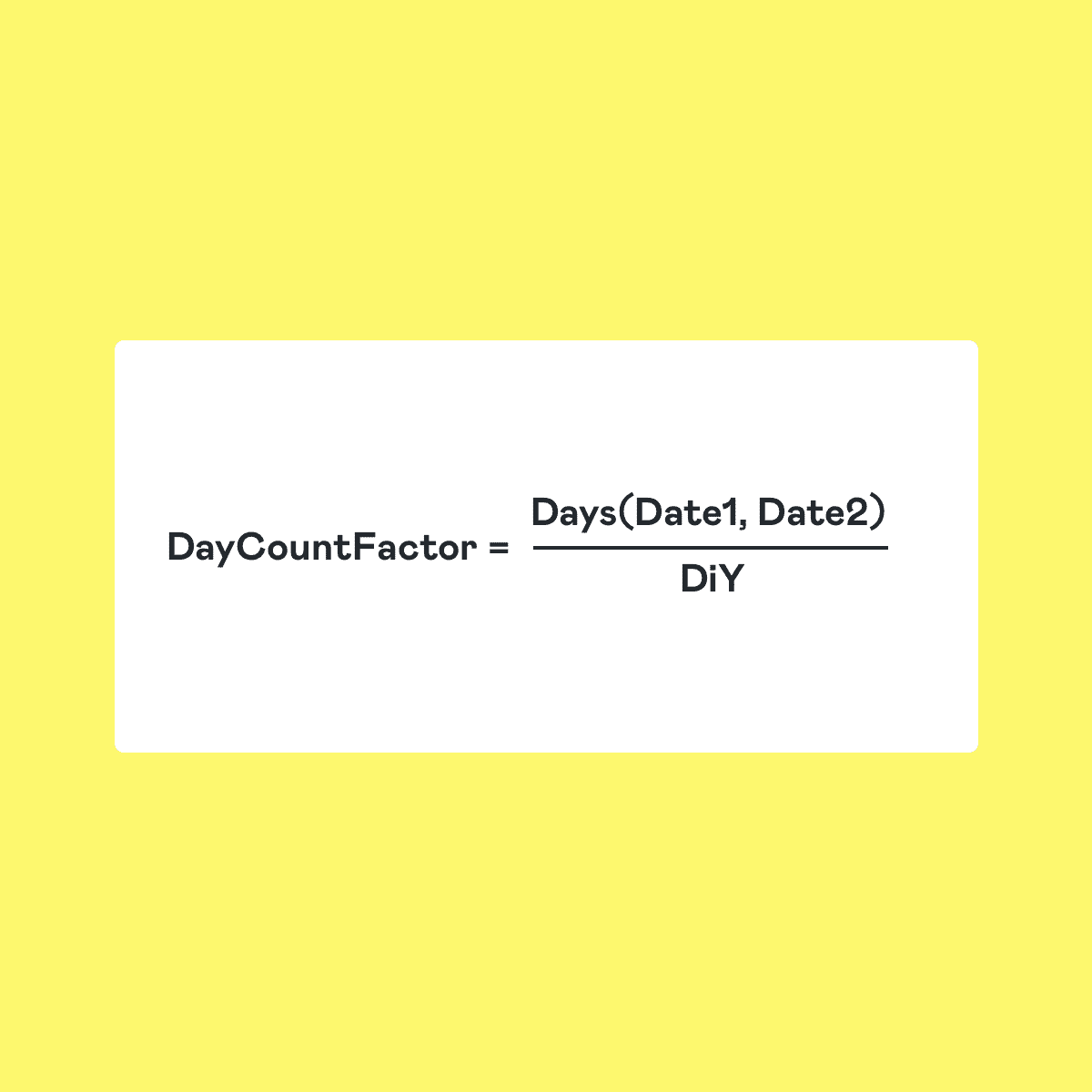

Interest calculation formula

How is my interest calculated?

We calculate interest as your credit balance multiplied by your APR and the DayCountFactor.

Interest varies from 8 – 17%. Interest rates are decided on an individual basis according to your credit rating and stated in our initial credit offer.

Date1: Starting date for interest accrual. In our case, the first day of the month.

Date2: Date through which interest is accrued. In our case, the last day of the month.

Days(Date1, Date2): Function giving the number of days between Date1 and Date2 on a Julian basis (all days counted). So, the number of days in the calendar month.

For example, September would be Days(1.9.2021,1.10.2021) = 30

DiY (Days in Year): 360 (standard in the banking world)

Your financial cushion

A credit card with credit line up to €5,000 to spend as you like – to soften all life’s expenses.

✔️ Invest in your business

Fund projects you can’t afford upfront. Cover urgent expenses – like that new software licence you need for ongoing work.

✔️ Cover payment gaps

Fluctuating income? Clients paying late? Bridge payment gaps and keep business running smoothly.

✔️ Split larger expenses

Big purchases can put a dent in your cash flow. Split them into manageable instalments, and pay them off over time.

✔️ Buy time

With credit card transactions due at the end of next month, you have ample time to budget.

For the self-employed

Up to €5,000 credit line. No individual loan pre-approval – for all life’s solo expenses.

Tailored interest rate

Competitive rates from 8–17% based on your credit score. No interest on interest.

Monthly billing

You’ll get a monthly credit card statement with your repayment amount plus interest and card fee.

Repay interest-free

Want to pay back early? Clear your balance by end-of-month, interest-free!

Use your credit card to invest in business, like a boss

More financial flexibility, a personalised credit limit and flexible payment terms. Here are 4 ways a business credit card adds value to your self-employed career, and help grow your business.

How your credit card helps you manage cash flow and stay debt free

Business trips, subscriptions, money-making projects, some business expenses just can’t wait. But sometimes a cash flow shortage prevents you from making those necessary purchases.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi is all you need – from business account, to online invoicing, to online bookkeeping.